Quick take: BRICS talk of a shared reserve currency is politically loud, but the practical hurdles remain large. Meanwhile, digital dollars and stablecoins are quietly deepening dollar dominance.

Introduction

For decades the U.S. dollar has not just been America’s currency — it has been the shorthand for global money.

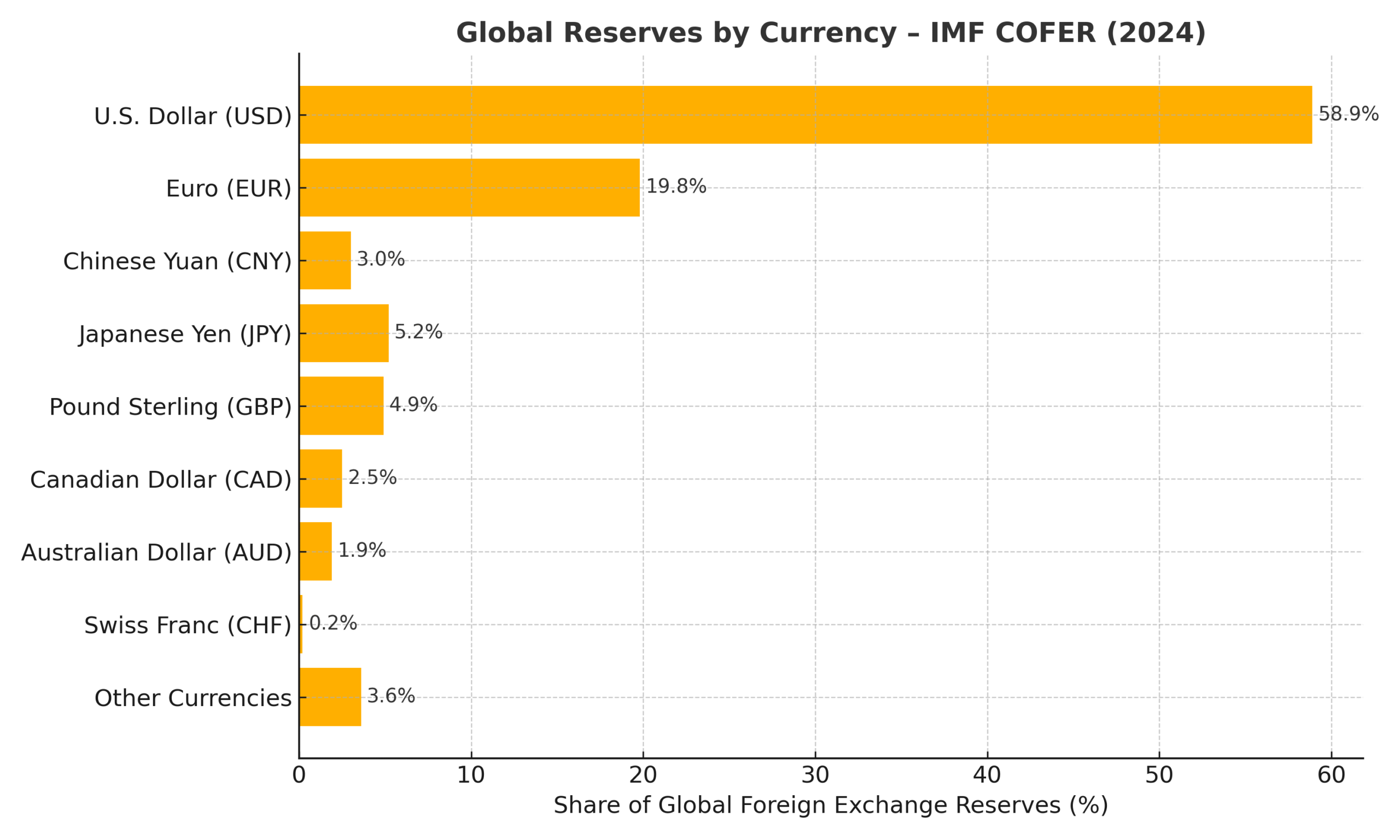

From oil contracts to central-bank reserves and everyday cross-border trade, the dollar is the default. Even now, roughly 60% of global reserves and more than 80% of international trade invoices are dollar-denominated. That scale gives the United States extraordinary leverage — from managing global liquidity to enforcing sanctions.

Into this system steps the BRICS group — Brazil, Russia, India, China and South Africa — proposing a shared reserve option. The idea has grabbed headlines and prompted debate: is this a genuine alternative to the dollar, or more of a political gesture? And how do new developments — especially digital dollars and stablecoins — change the equation?

Why the Dollar Still Rules

The dollar’s strength comes down to two things: depth and trust. The U.S. Treasury market is the largest and most liquid safe-asset market; it allows central banks and big investors to park large sums without worrying about finding a buyer later. The post-1970s “petrodollar” system — oil priced largely in dollars — also sustains steady international demand.

Payments infrastructure matters too. Systems like SWIFT and decades of dollar-based contracts make settling in USD easy and predictable. Even nations that rarely trade with the United States often prefer dollars simply because they are universal and dependable.

History’s Lessons: Past Challengers

The dollar has faced rivals before. The euro, when it launched in 1999, was briefly seen as a credible competitor and attracted a sizable share of reserves. But political fragmentation, sovereign debt crises, and the lack of a unified fiscal policy limited its reach.

The IMF’s Special Drawing Rights (SDRs) offered a multi-currency alternative, but businesses prefer one clear anchor currency for trade and pricing. The net result: multiple attempts to unseat the dollar have altered the landscape, but haven’t overturned the greenback’s central role.

The BRICS Proposal — What’s on the Table?

What BRICS members have discussed ranges from a commodity-backed digital currency to a blockchain-based settlement token. Several motivations underlie the talk:

- Russia: find ways to reduce dependence on Western financial rails and bypass sanctions.

- China: accelerate the yuan’s role in global finance and lessen reliance on the dollar.

- India, Brazil, South Africa: seek greater autonomy and more direct trade settlement options, but

worry about being pulled into a system dominated by any one member.

The key practical questions remain unanswered: Would a BRICS currency be freely tradable? Would it be backed by clear reserves or commodities? Or would it be tightly controlled and thus less useful as a global reserve?

The Obstacles in the Path

Here’s the blunt truth: a global reserve currency needs trust, liquidity and convertibility. BRICS faces problems on all three fronts.

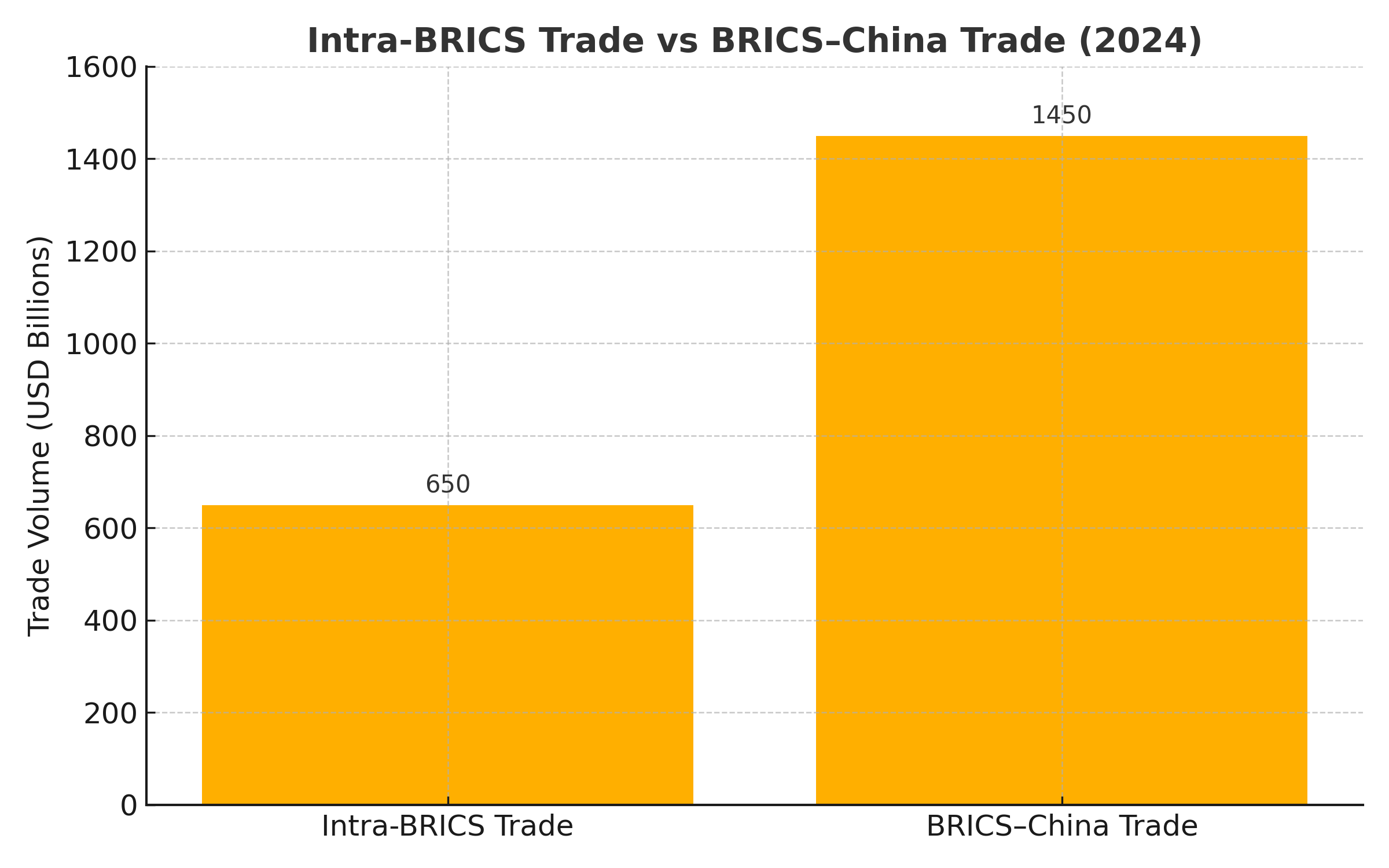

Politically, BRICS is not a unified bloc — India and China have ongoing tensions; Brazil and South Africa are wary of Beijing’s influence. Financially, many BRICS currencies are volatile and capital markets are shallow compared with the U.S. Treasury market. China’s capital controls limit yuan convertibility, making it hard for foreign investors to hold large liquid positions. And trade patterns show BRICS countries trade heavily with China, not equally with each other — a setup that risks making any BRICS currency effectively yuan-centered.

China’s Yuan Experiment — Lessons Learned

Beijing has been deliberate about internationalizing the yuan: currency swaps, the so-called “PetroYuan” experiments, and bilateral arrangements with trading partners. Yet the yuan still represents a small slice of official reserves. Without full convertibility and predictable policy, global investors remain cautious.

That hesitation is telling: if the BRICS plan leans on the same policies that limit yuan trust — limited transparency, tight capital controls, or sudden policy shifts — it will inherit those weaknesses, magnified by intra-bloc disagreements.

The Digital Twist: America’s Quiet Countermove

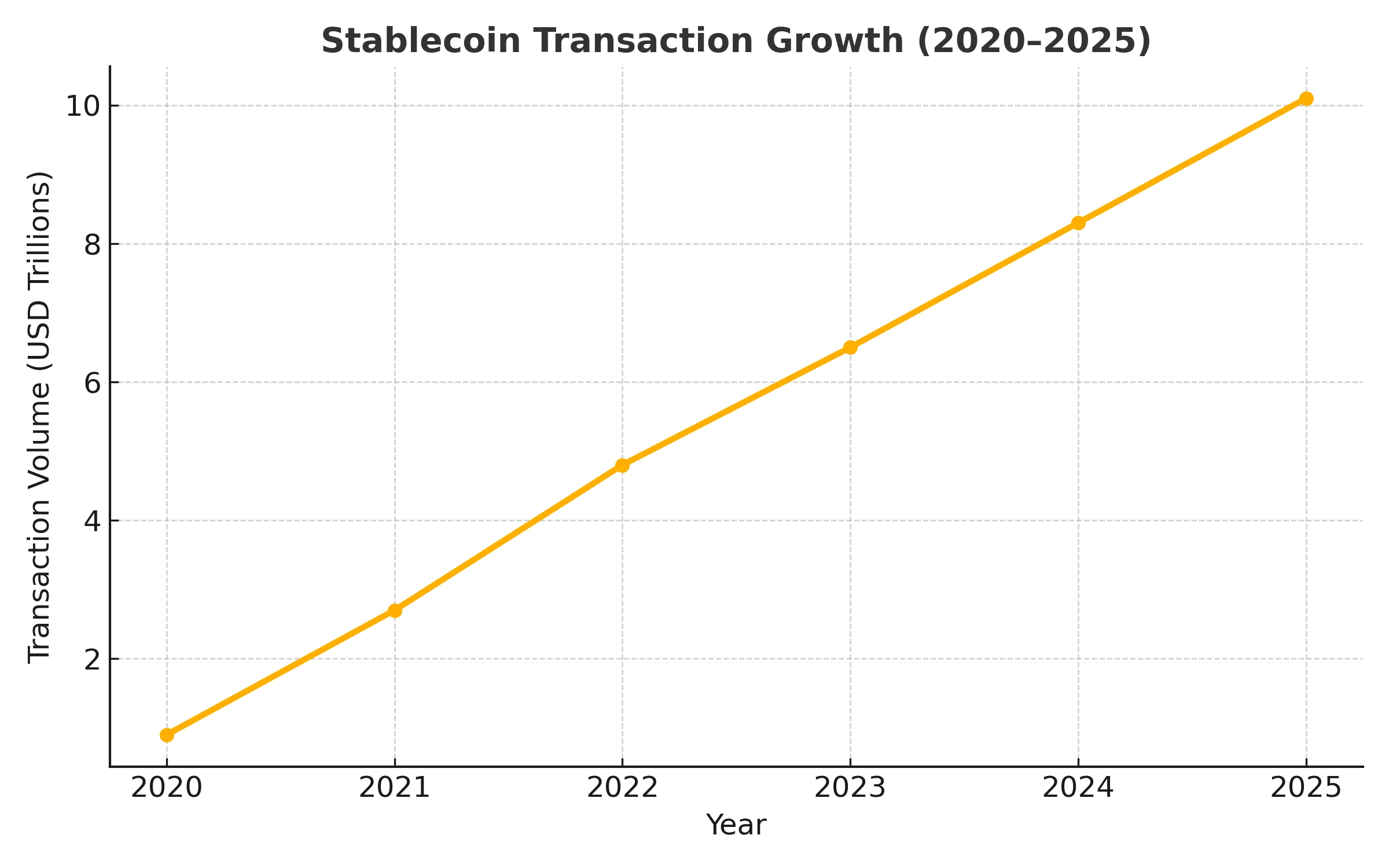

While BRICS debates structural design, the U.S. is evolving its own advantage — digitally. Stablecoins (USDT, USDC) and other dollar-pegged instruments have become the plumbing of the crypto economy, handling huge volumes. In nations with high inflation or weak local currencies, people frequently prefer holding dollar stablecoins to protect savings.

At the same time, U.S. regulators are moving from resistance to a regulatory framework, and the Federal Reserve is studying the possibility of a central bank digital currency (CBDC). That combination — regulated stablecoins plus a possible digital dollar — would let the dollar extend its practical reach into instant, cross-border digital payments. If global users can access regulated, liquid digital dollars, why switch to an untested BRICS token?

Where This Could Lead

The future could take a few shapes:

- Dollar dominance continues: digital evolution locks the dollar in as both traditional and digital anchor.

- Multipolarity: several currencies (Euro, Yuan, BRICS token) coexist, but the dollar remains the key reference.

- Regional BRICS currency: useful for specific trade corridors (e.g., Russia–China) and sanctioned economies, but not globally dominant.

The world’s emerging currency blocs — the Dollar remains dominant, the Euro holds regional strength, the Yuan’s influence expands through Asia, and BRICS nations explore a shared alternative.

The world’s emerging currency blocs — the Dollar remains dominant, the Euro holds regional strength, the Yuan’s influence expands through Asia, and BRICS nations explore a shared alternative.Conclusion

The idea of a BRICS reserve currency is bold and politically resonant — but it’s not yet a finished financial product. The obstacles are real: trust deficits within the bloc, low liquidity compared with U.S. markets, convertibility limits, and the practical risk that the system could turn into a yuan-dominated zone.

Meanwhile the United States is not passive. Through regulated stablecoins and a potential digital dollar, the dollar’s reach is expanding into the digital era. Monetary power rarely flips overnight. The likeliest outcome is a more fragmented, multipolar currency landscape — but one in which the dollar remains the anchor, chosen for its depth, openness, and reliability.