From the RBI boardroom to your EMI a complete breakdown of how monetary policy actually moves through the banking system.

THE 2025 EASING CYCLE: A RECAP

- February 2025: Repo rate cut from 6.50% to 6.25%

- April 2025: Repo rate cut to 6.00%

- June 2025: Repo rate cut to 5.50%

- October 2025: Held at 5.50%

- December 2025: Cut to 5.25%

- February 2026: Held at 5.25% (current)

Total cuts in 2025: 125 basis points- one of the sharpest easing cycles since the COVID-19 period.

What Is the Repo Rate And Why Does It Matter?

The repo rate is the interest rate at which the Reserve Bank of India lends money to commercial banks. When banks need short-term liquidity, they borrow from RBI by pledging government securities. Currently, that rate stands at 5.25%.

Why Does This One Number Control the Entire Economy?

The repo rate is the anchor rate for the entire financial system. Every other interest rate in the economy, your home loan EMI, your FD return, corporate bond yields, even stock market valuations is directly or indirectly tied to the repo rate. When RBI cuts the repo rate, it is signaling: “Money should be cheaper. Banks, lend more. Businesses, borrow and invest. Consumers, spend.” When RBI raises the repo rate, it is saying the opposite: “Inflation is rising. Cool down. Save more, borrow less.”

The repo rate is RBI’s primary tool for controlling inflation while supporting economic growth. It is the single most powerful lever the central bank has. This single number acts as the anchor for the entire financial system. Home loans, FD returns, corporate borrowing costs, and even stock market valuations are indirectly influenced by it.

The Cascade Effect

| Interest Rate Area | What Happens When Repo Rate Falls |

|---|---|

| Bank Borrowing Cost | Banks borrow cheaper from RBI |

| MCLR / EBLR | Internal benchmarks decline |

| Home Loan EMIs | EMIs may reduce |

| Car & Personal Loans | Interest rates fall, making borrowing more attractive |

| FD Returns | Deposit rates gradually fall. Banks offer lower FD rates. |

| Stock Valuations | Lower discount rates → higher equity valuations (generally) |

The 6 Stages of Monetary Policy Transmission

When RBI Governor announces a rate cut at 10:00 AM on a Thursday, what happens next is a carefully choreographed sequence that unfolds over weeks and months. Here is the complete flow, stage by stage.

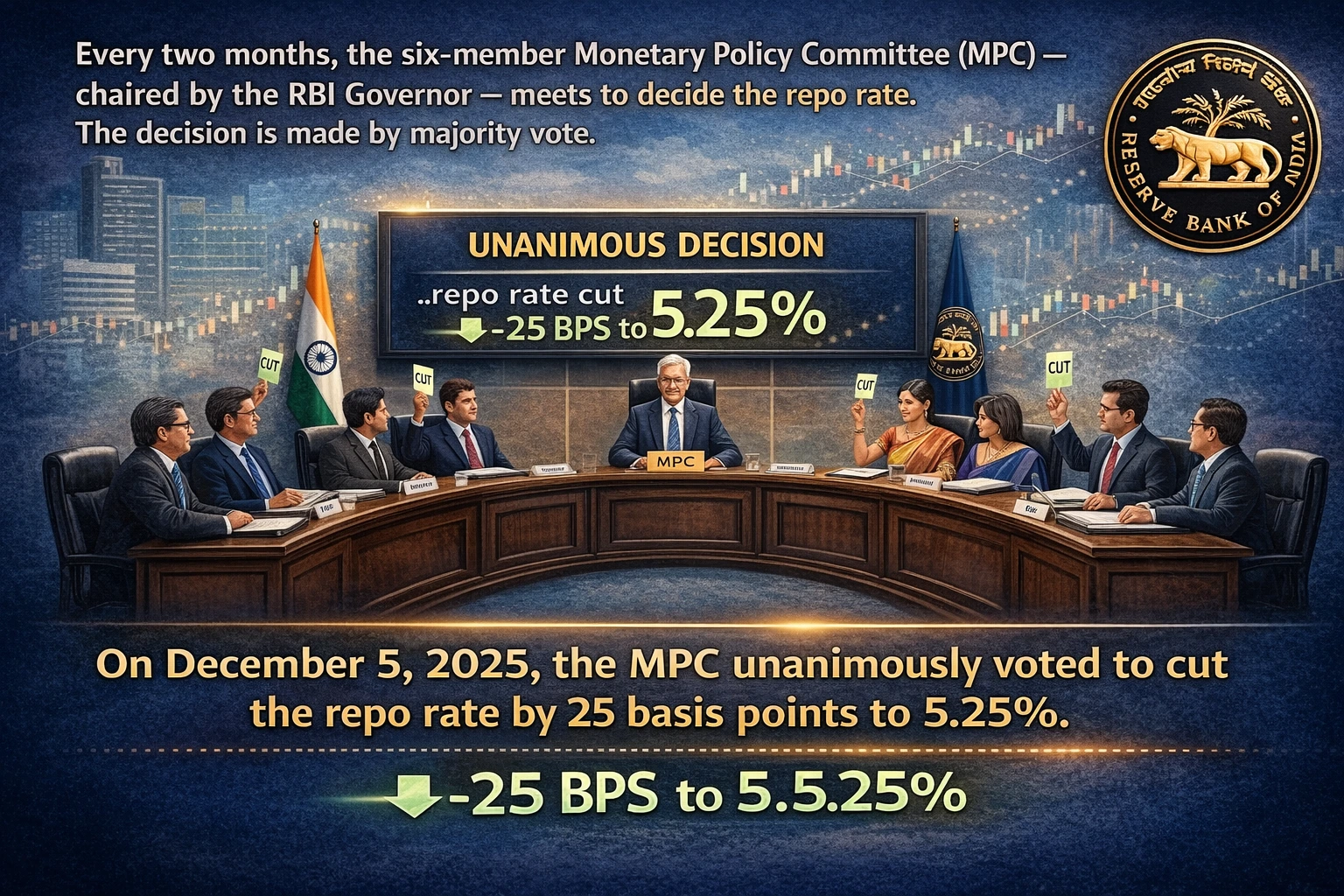

Stage 1: RBI Announces the Decision

The Monetary Policy Committee meets every two months to decide the repo rate. Along with the rate change, RBI announces liquidity measures, inflation outlook, and GDP projections. In December 2025, RBI also announced bond purchases and a forex swap to speed up liquidity transmission.

The announcement includes:

- The new repo rate (5.25%)

- The new Standing Deposit Facility (SDF) rate — where banks park excess funds with RBI (now 5.00%)

- The new Marginal Standing Facility (MSF) rate — emergency borrowing rate for banks (now 5.50%)

- The policy stance (currently “neutral” — meaning RBI is flexible on future moves)

- GDP growth projections (7.4% for FY26) and inflation projections (2.1%)

Simultaneously, RBI also announced open market operations (OMO) to buy ₹1 lakh crore worth of government bonds and a $5 billion forex swap, both designed to inject liquidity into the banking system and speed up transmission.

Stage 2: Banks Recalculate Cost of Funds

Immediately after the announcement, bank treasury teams calculate their updated cost of funds. This includes deposit rates, interbank borrowing, and repo borrowing. Since existing deposits are locked at older rates, transmission never happens instantly.

A bank’s cost of funds is the weighted average interest rate it pays to gather deposits and borrow money. This includes:

- Savings account interest (typically 2.75–4.00%)

- Fixed deposit interest (5.00–7.50% depending on tenure)

- Borrowing from RBI via repo (now 5.25%)

- Borrowing from other banks (interbank market rates)

- Bonds issued by the bank to raise capital

When the repo rate falls, the marginal cost – the cost of raising the next rupee falls immediately. But the average cost of funds (which includes all existing deposits locked at older, higher rates) falls more slowly.

This is why transmission is never instant. A bank with ₹10 lakh crore in deposits most of which were raised when rates were higher cannot immediately cut its lending rates by the full 25 bps just because the repo rate fell by 25 bps. The math does not work.

Stage 3: Banks Revise MCLR and EBLR

Now comes the critical step where the rate cut actually starts affecting borrowers. Banks use two main systems to price loans:

System 1: MCLR (Marginal Cost of Funds Based Lending Rate)

MCLR is an internal benchmark calculated monthly by each bank. It is based on:

- Marginal cost of funds (what it costs to raise the next rupee)

- Operating costs (salaries, rent, technology)

- Tenor premium (longer loans = higher risk = higher premium)

- Negative carry on CRR (banks must park 4.50% of deposits with RBI at zero interest — this is a cost)

Banks publish MCLR rates on the 1st of every month for different loan tenures: overnight, 1-month, 3-month, 6-month, 1-year. Most home loans are linked to the 1-year MCLR.

When RBI cuts the repo rate, banks gradually reduce their MCLR, but not by the full amount, and not immediately. For instance, after the December 2025 cut, SBI reduced its 1-year MCLR by just 5 basis points (from 8.85% to 8.80%), even though the repo rate fell by 25 bps.

System 2: EBLR (External Benchmark Lending Rate)

EBLR also called RLLR (Repo-Linked Lending Rate) is directly tied to the RBI repo rate. If the repo rate falls by 25 bps, the EBLR falls by 25 bps. Period. This system was introduced in October 2019 to improve transparency and speed up transmission.

Currently, about 85% of private bank loans and 45% of public sector bank loans are EBLR-linked. For borrowers with EBLR loans, the benefit is fast and direct. For borrowers with older MCLR loans, transmission is slower and incomplete.

| Feature | MCLR System | EBLR / Repo Linked |

|---|---|---|

| Linked To | Bank’s internal cost of funds | External benchmark (repo rate) |

| Reset Frequency | Once a year (on reset date) | Monthly/Quarterly |

| Transmission Speed | Slow (3 to 6 month lag) | Fast |

| Rate Pass-through | Partial | Full |

This difference explains why some borrowers see immediate EMI cuts while others wait months.

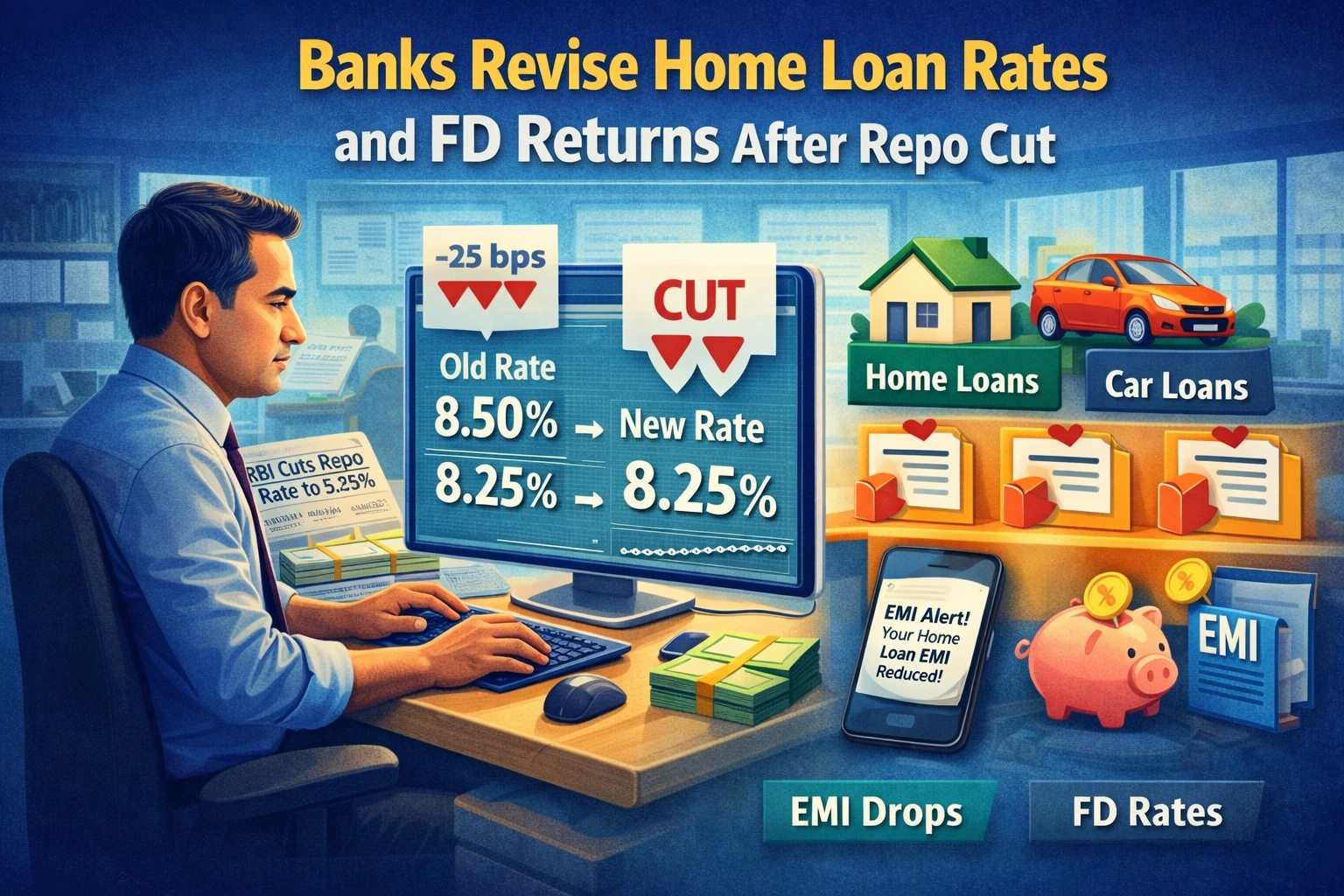

Stage 4: Your Loan Rate Resets

This is where it gets personal. Whether your EMI falls and by how much depends entirely on which type of loan you have and when your reset date is.

Scenario A: You Have an EBLR / Repo-Linked Loan

Your loan interest rate is repo rate + spread. For example: 5.25% (repo) + 2.50% (spread) = 7.75% final rate.

- Reset happens automatically on your next billing cycle (monthly or quarterly)

- You see the benefit within 1–3 months

- The rate cut is passed on in full (if repo falls 25 bps, your rate falls 25 bps)

Example: If you had a ₹50 lakh home loan at 8.00% with a 20-year tenure, your EMI was ₹41,822. After the December cut (assuming your rate drops to 7.75%), your new EMI is ₹40,943. A monthly saving of ₹879.

Scenario B: You Have an MCLR-Linked Loan

Your loan interest rate is MCLR + spread. For example: 8.80% (1-year MCLR) + 0.50% (spread) = 9.30% final rate.

- Reset happens only once a year, on your loan anniversary date

- If your anniversary is in March 2026, you won’t see any benefit until March 2026

- Even then, the rate cut is partial banks typically pass on 20–60% of the repo cut via MCLR

This is the frustrating reality for millions of Indian borrowers with older home loans. They watch the news, see “RBI cuts rates,” and then… nothing happens to their EMI for months.

Scenario C: You Have a Fixed-Rate Loan

Your rate is locked for the tenure. No change. No benefit. You are completely insulated from RBI policy for better or worse.

Stage 5: Deposit Rates Adjust Slowly

Banks typically reduce FD rates faster than lending rates to protect their Net Interest Margin. For example, a 1-year FD dropped from around 7.10% in early 2025 to roughly 6.50% by early 2026.

Here is where it gets interesting. When RBI cuts rates, banks reduce lending rates (reluctantly). But they also reduce deposit rates — and they do this much faster and more aggressively.

Why? Because when money is cheaper, banks do not need to compete as hard for deposits. If you can borrow from RBI at 5.25%, why pay depositors 7.50%?

After the June 2025 repo cut, most banks reduced their FD rates by 25–50 bps within 4–6 weeks. By contrast, MCLR cuts averaged just 5–10 bps over the same period. The asymmetry is deliberate — banks are protecting their Net Interest Margin (NIM), the difference between what they earn on loans and what they pay on deposits.

Stage 6: The Broader Economy Responds

The final stage is the one RBI actually cares about: the real economy. Cheaper credit should translate into more borrowing, more spending, more investment, and ultimately higher GDP growth.

Here is how the transmission flows outward:

- Consumers with lower EMIs have more disposable income → they spend more on discretionary goods

- Businesses can borrow cheaper → they invest in new projects, hire workers, expand capacity

- Real estate becomes more affordable → housing demand picks up, construction activity rises

- Stock markets rally (lower discount rates make future earnings more valuable today)

- Banks see higher credit growth → loan books expand, profitability improves

In the 2025 easing cycle, RBI cut rates by 125 bps specifically to revive credit growth, which had slowed sharply in H1 FY26. The result? By February 2026, bank credit growth has picked up to 11–12% YoY, and GDP growth projections have been revised upward to 7.4% for FY26.

Why Transmission Is Never Perfect

If you have been paying attention, you have noticed something: RBI cut rates by 125 bps in 2025, but most home loan rates have only fallen by 60–80 bps. Where did the other 45–65 bps go? This is called incomplete transmission, and it is a permanent feature of India’s banking system. Here is why it happens:

Reason 1: Deposit Rate Stickiness

Banks cannot cut deposit rates too aggressively, because they compete with mutual funds, corporate bonds, and even gold for savers’ money. If SBI offers 6.00% on a 1-year FD while a debt mutual fund offers 7.50%, depositors will leave. This limits how much banks can reduce their cost of funds and therefore how much they can cut lending rates.

Reason 2: The MCLR Lag Problem

Nearly 55% of outstanding loans in public sector banks are still MCLR-linked. These loans reset only once a year. Even if banks cut MCLR today, the benefit reaches borrowers months later. By contrast, EBLR loans which are more common in private banks transmit much faster.

Reason 3: Banks Protect Their Margins

Banks are businesses. Their Net Interest Margin (NIM) the difference between loan income and deposit cost is their profit. When RBI cuts rates, banks try to preserve their NIM by cutting deposit rates faster than lending rates. This asymmetry is intentional.

Reason 4: Risk Premia Stay Constant

Your loan rate = benchmark + credit risk premium + bank spread. Even if the benchmark (repo or MCLR) falls, your credit risk premium (based on your CIBIL score, income, employment) stays the same. A high-risk borrower does not suddenly become low-risk just because RBI cut rates.

The Transmission Scorecard

| Loan Type | Typical Transmission | Time Lag |

|---|---|---|

| EBLR / Repo-Linked | 80–100% | 1–3 months |

| MCLR-Linked | 30–60% | 6–12 months |

| Fixed Rate Loans | 0% | N/A |

| Fixed Deposits | Near 100% | Immediate on renewal |

What Should You Do Right Now?

Understanding transmission is not just academic. It has real, practical implications for your financial decisions. Here is what you should be doing based on where you are in the system.

If You Have a Home Loan

- Check your loan type: Is it EBLR or MCLR? Look at your loan agreement or ask your bank

- If MCLR: Consider switching to EBLR. Most banks allow this for a nominal fee (₹2,000–5,000). Over 20 years, you could save ₹10–15 lakh

- If EBLR: You are already in the best system. Your EMI will adjust automatically within 1–3 months

- Check your reset date: If your MCLR loan resets in March, you will see the benefit in April

If You Have Fixed Deposits

- Do not lock long tenures right now: FD rates are falling. If you lock in a 5-year FD at 6.50% today and rates rise to 7.50% next year, you lose

- Ladder your FDs: Split your corpus into 1-year, 2-year, and 3-year FDs so part of your money resets every year

- Consider debt mutual funds for 3+ year horizons: After indexation (if applicable), they may offer better post-tax returns than FDs

If You Are Planning to Borrow

- Wait 2–3 months if you can: Transmission takes time. The full benefit of December’s rate cut will be visible by March 2026

- Negotiate hard: Banks have room to cut. Ask for a lower spread over EBLR. Even 10 bps matters over 20 years

- Shop around: Private banks typically transmit faster than PSU banks. Compare effective rates, not just advertised rates

If You Are an Investor

- Bank stocks benefit in the medium term: Lower rates → higher credit growth → better loan book growth. But watch NIMs

- Housing and auto sectors get a boost: Lower EMIs = higher affordability = more demand

- Bond funds rally when rates fall: If you think RBI will cut more, long-duration debt funds will give capital gains

The Bottom Line

When RBI Governor Sanjay Malhotra announced the December 2025 rate cut, it was not a light switch that instantly made borrowing cheaper. It was the first domino in a chain that would take weeks and months to fully play out.

The repo rate fell by 25 bps. Banks recalculated their cost of funds. MCLR and EBLR were revised. Loans reset on their anniversary dates. Deposit rates were cut. Credit growth picked up. The stock market rallied. GDP projections were revised upward. This is monetary policy transmission, a slow, messy, imperfect process that nonetheless moves the entire economy.

For you, the individual borrower or saver, the lesson is simple: understand which part of the system you are in. If you have an EBLR loan, you are already getting the best deal. If you have an MCLR loan, switch. If you have FDs, do not lock long tenures in a falling rate environment. If you are planning to borrow, wait a few months and negotiate hard.

The flow from RBI to your EMI is not instant. But it is real. And understanding it gives you power.