Introduction

India is standing at one of those rare moments where everything seems to be lining up. A growing economy, steady reforms, record-high forex reserves, and strong demand at home — it all points to the possibility of a golden run in the next 2–3 years. Yes, the world outside is still full of uncertainties, but India’s resilience, demographics, and reform momentum give it a unique edge. If things go right, this could well be the start of a long bull run in both the economy and the markets.

GST 2.0 – The Game Changer

Think of GST 2.0 as a wiring upgrade for the tax system. Instead of a messy, multi-slab structure, businesses will now deal with just two rates — 5% and 18%. It’s simpler, faster, and cleaner.

- Simpler compliance → fewer disputes and wasted hours.

- Lower taxes on essentials → leaves more money in people’s hands to spend.

- Easier to do business → makes India more attractive to foreign investors.

- Brings small businesses and MSMEs more firmly into the formal economy.

- Most experts estimate: could add about 0.5–1% to GDP growth over the next 2–3 years.

In short, GST 2.0 is more than just tax reform — it’s a growth push that could touch almost every sector.

Global Tailwinds & FTAs

As global supply chains shift away from over-dependence on China, India is finding itself in the sweet spot. This “China+1 strategy” is already drawing interest, and India’s Free Trade Agreements (FTAs) with countries like the UAE, Australia, EU, and Japan make it even more attractive.

- Exports in many categories get duty-free access.

- Foreign companies see India as a safer and more reliable destination.

- Deeper integration with global trade flows.

Manufacturing & Make in India

The Make in India push and PLI schemes are not just buzzwords anymore — they’re actually bringing in big money and technology. Sectors seeing the most action include:

- Electronics & Semiconductors

- EVs & Battery manufacturing

- Defence & Aerospace

- Pharma & Biotech

- Renewables & Green Hydrogen

Billions of dollars are being invested, which means jobs, technology transfer, and a stronger global presence for India’s factories.

Sectoral Growth Engines

- Defence: With 75% of procurement focused on local products, exports are climbing — think Tejas jets, drones, and missile systems.

- Railways: Massive ₹10 lakh crore modernization — more Vande Bharat trains, electrification, and freight corridors.

- Infrastructure: ₹11.1 lakh crore projects under NIP — roads, ports, airports, and even smart cities.

- Agriculture: Exports above $50B, digital and organic farming growing fast, FTAs opening new markets.

- Logistics: GatiShakti plan aims to cut logistics costs from ~14% to below 9% of GDP — a big competitiveness boost.

New-Age Growth Drivers

India’s story today is not just smokestacks and highways. New-age themes are powering ahead too:

- Digital & Fintech: UPI, ONDC, and IndiaStack are reshaping payments and online trade.

- Green Economy: EVs, solar, hydrogen — and billions in FDI flowing into them.

- Healthcare & Pharma: From affordable medicines to med-tech, India is a global hub.

- Banking & Finance: Cleaner balance sheets and tech-led growth.

- Demographics: A young, ambitious population that keeps the consumption engine running.

Retail Participation – The Silent Revolution

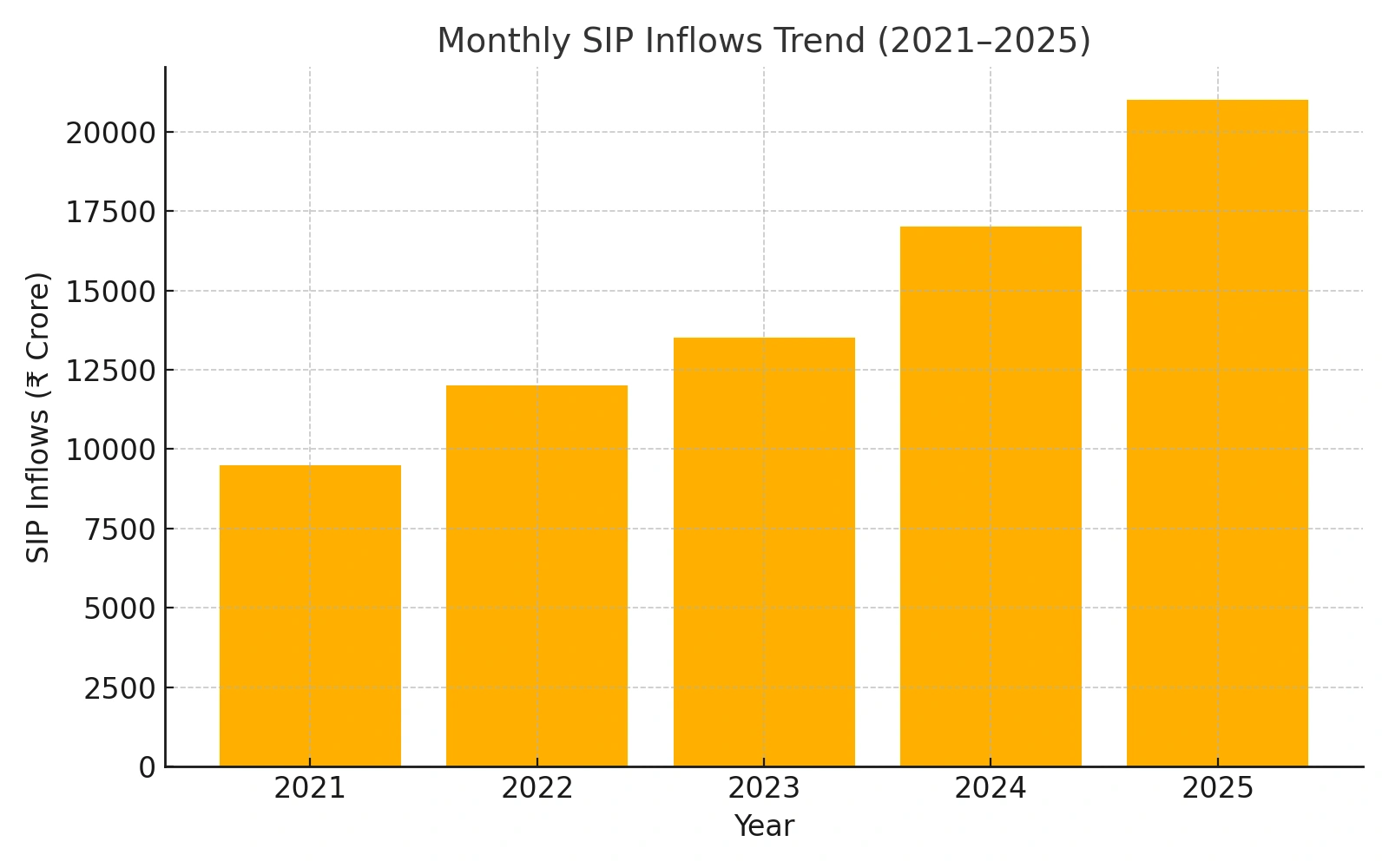

Here’s a striking change: for the first time ever, everyday investors like you and me now make up over half of NSE’s daily turnover. SIP inflows are crossing ₹20,000 crore every month, and the number of Demat accounts is well past 15 crore.

This means markets aren’t just at the mercy of foreign investors anymore. Domestic money is providing a strong cushion — and that makes corrections shallower and recoveries quicker.

Indian Stock Market – Valuation & Bull Run Potential

Yes, Indian equities underperformed a bit recently — IT slowdown, global jitters, you know the story. But that’s exactly why valuations today look far more reasonable than a year ago.

- Nifty PE ratio: Around 20x — slightly higher than peers, but backed by stronger growth prospects.

- Market cap-to-GDP ratio: ~105% — healthy and not overheated.

- Earnings outlook: Manufacturing, banks, infra, and energy all looking strong.

Bull Run Drivers (2025–2027):

- GST 2.0 lifting consumption.

- PLI and FTAs boosting exports and manufacturing.

- Infra push creating multiplier effects.

- Retail flows powering liquidity.

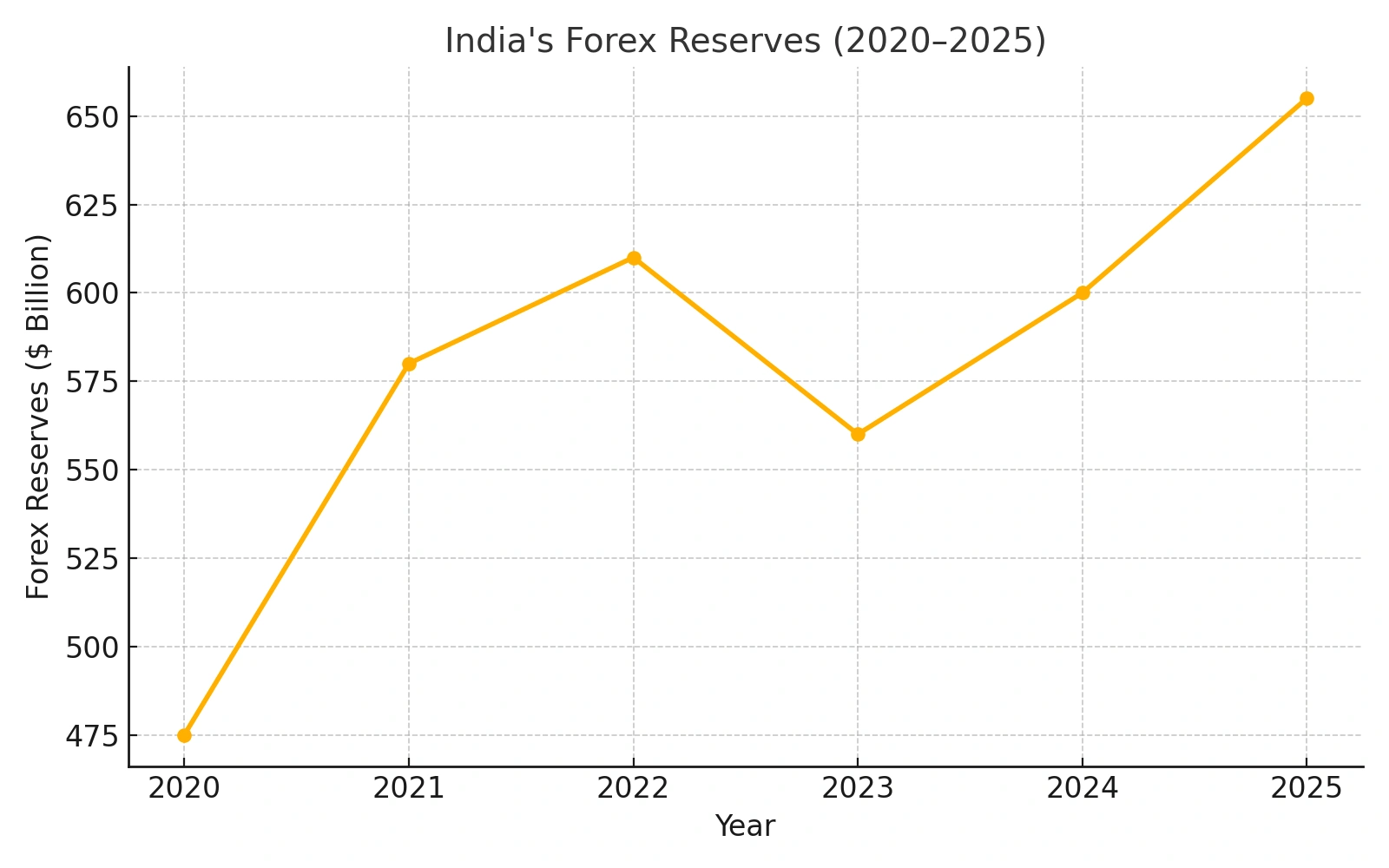

- Record forex reserves supporting stability.

Foreign Reserves – Record High

India now holds $650–660 billion in forex reserves — the highest ever. This pile of reserves is more than just a number:

- It gives currency stability even during global storms.

- It reassures foreign investors that India is a safe bet.

- It ensures enough firepower for imports, energy needs, and debt servicing.

Risks to the Bull Run

Of course, no story is without its risks. A few things that could throw India off track:

- Oil price shocks — still a weak spot since we import most of our crude.

- US Fed tightening — higher US rates can spook emerging market inflows.

- Geopolitical tensions — a conflict in the Middle East, Taiwan, or Ukraine could spill over.

- Monsoon & climate issues — agriculture and inflation remain vulnerable.

Data Sources & References

This analysis uses verified and official data sources:

- Reserve Bank of India (RBI) – Weekly Forex Reserves Data

- Ministry of Finance – Union Budget & Economic Survey

- SEBI – Market Participation & Demat Accounts

- NSE India – Market Turnover & Indices

- IMF World Economic Outlook

- World Bank – India Economic Indicators

- Ministry of Commerce – Trade & FTAs

Conclusion

Put it all together — reforms, retail money, infrastructure, and a war chest of forex reserves — and India looks well placed for a powerful run from 2025 to 2027. The strength here isn’t just in speculation, it’s in fundamentals lining up at the right time.

For long-term investors, that simply means one thing: staying invested in India’s growth story could be more rewarding than ever.

Disclaimer

This outlook is based on current data and policies. Unexpected global shocks or sudden policy changes could alter the picture. Please do your own due diligence before making investment decisions.

Pingback: A silent middle-class transformation

Pingback: Rupee Internationalisation - Making the Indian Rupee Global - ProsperPocket