Markets have a way of exaggerating. They take a good idea, add cheap money and excitement, and turn it into something much bigger than the fundamentals can justify. AI has given us dazzling gains. Whether it can keep them is another question entirely.

1. What Really Happened

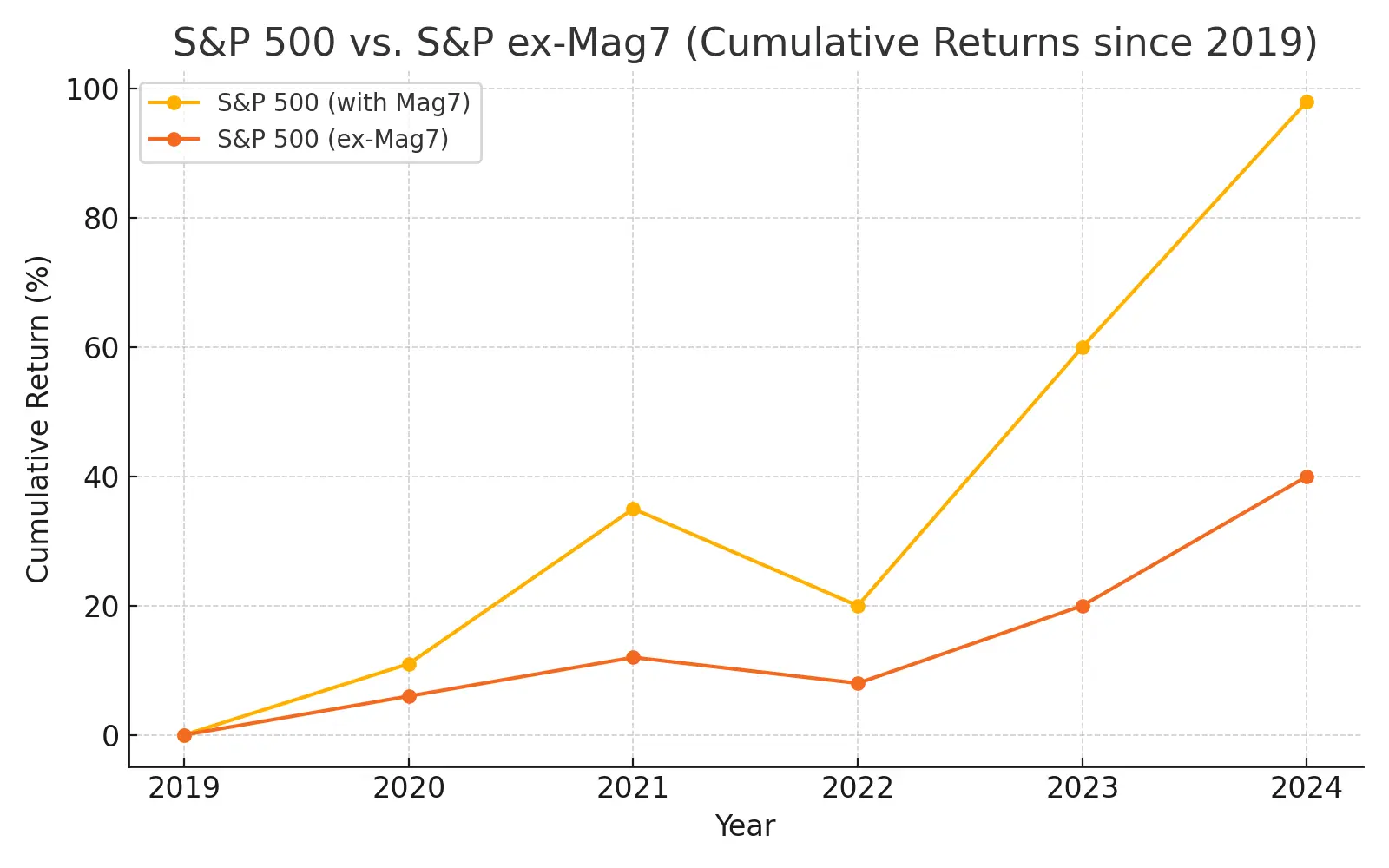

On the surface, Wall Street looks like it’s been on a tear. The S&P 500 has almost doubled in five years, pumping out annual returns of 14–15%. That sounds like an economy firing on all cylinders.

But here’s the catch: take away seven companies — Apple, Microsoft, Amazon, Alphabet, Meta, Tesla and Nvidia — and the index suddenly looks ordinary. Without them, yearly growth would have been closer to 6–8%, which is just the historical average. Hardly a golden age.

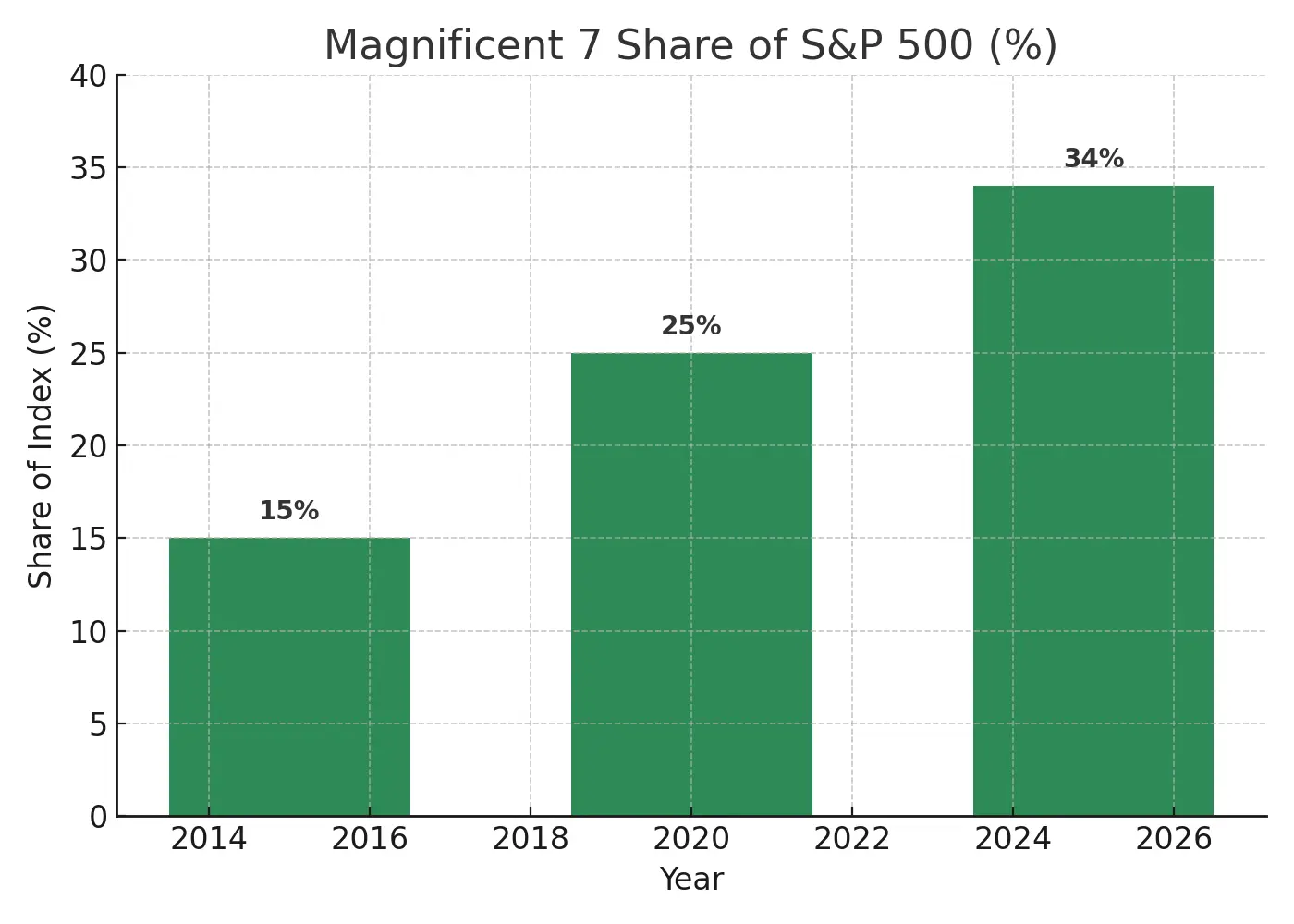

Those seven stocks now make up roughly a third of the S&P 500. Ten years ago they were half that. Their dominance means the fate of the entire index — and much of the world’s wealth tied to it — now hinges disproportionately on the prospects of a tiny corporate elite.

2. Why AI and Tech Dominated the Rally

So why did just seven companies carry the market on their backs? The short answer: the AI story was irresistible, and these firms were best placed to sell it.

Take Nvidia. In five years its shares rose more than tenfold, turning a chipmaker once known mainly to gamers into the most valuable semiconductor firm in history. Microsoft and Alphabet promised to weave AI into search, cloud and office software. Meta reinvented itself as an “AI-first” company. Even Tesla, with its driver-assistance systems, managed to catch the wave.

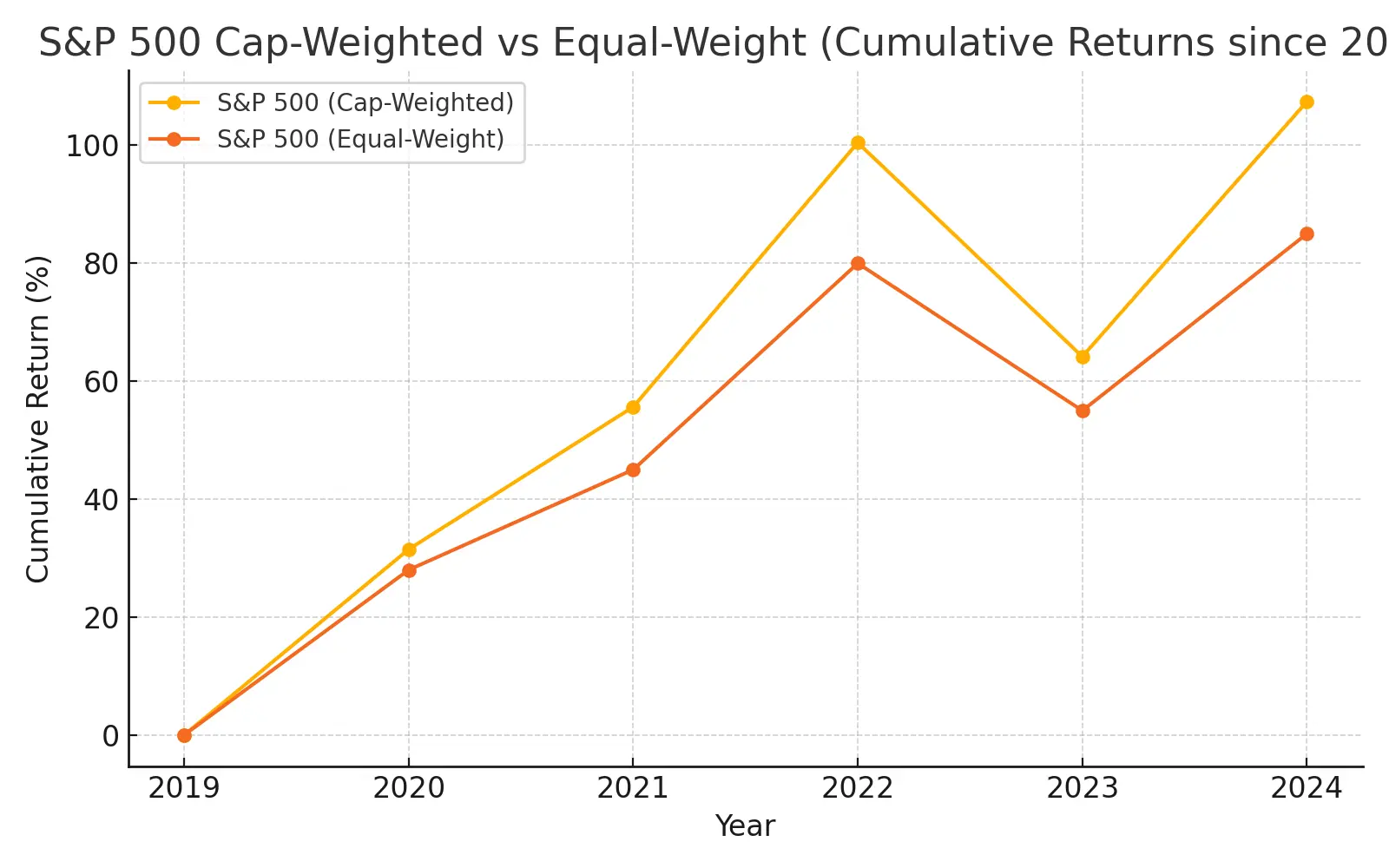

The mechanics of the index amplified the effect. The S&P 500 is weighted by market value, so when a giant stock races ahead it drags the benchmark with it. Each extra trillion dollars in market cap adds more fuel. Meanwhile, the rest of the market sat still. Banks, utilities, consumer staples — the sort of companies that usually provide ballast — barely moved. All eyes, and all capital, chased the AI dream.

3. This narrow rally shows the hallmarks of an AI stock bubble

A healthy bull market usually lifts most boats. This one hasn’t.

The Magnificent Seven now account for about a third of the S&P 500’s weight — double what they represented a decade ago. That level of concentration is unusual, and risky. Take them out of the index and the story changes completely: returns fall by more than half, back to the dull 6–8% range investors have long been used to.

Sector performance data confirms this — banks, utilities and staples have barely moved in recent years (source).

Look at the median stock — the “typical” company in the index — and the picture is even gloomier. Most firms badly lagged the headline numbers. For many sectors, from banks to utilities to consumer staples, the last five years were flat at best.

In other words, what has been sold as an American boom is really an AI-and-tech boom in disguise. The market may look broad on paper, but in reality it rests on a very narrow foundation.

4. Why the AI Stock Bubble Could Burst

Every boom feels permanent until it doesn’t. The danger for investors today is that the Magnificent Seven are priced for perfection — and perfection rarely lasts.

Valuations are stretched. Nvidia, Microsoft and the rest trade at earnings multiples that assume years of uninterrupted growth. A single weak quarter, or even slightly slower sales of AI chips or cloud services, could be enough to shake confidence.

The industry is also pouring billions into new data centers and GPU farms. That kind of investment boom often ends in oversupply. If demand disappoints, prices collapse — just as they did in solar panels and fiber-optics two decades ago.

Competition is another threat. AMD, Google and Amazon are building their own chips. Chinese firms are racing to develop cheaper alternatives. If AI hardware and models become commodities, profit margins will shrink.

Add to that the usual list of hazards: tighter regulation, higher interest rates that depress tech valuations, and the fact that nearly every big fund owns the same handful of stocks. A rush for the exits could turn orderly selling into a rout. And lurking in the background is geopolitics: the U.S.–China chip war could upend supply chains overnight.

For now, investors are still chasing the dream. But history suggests it doesn’t take much for dreams to unravel.

5. China’s DeepSeek Example

If investors needed a reminder that AI may not remain a Western monopoly, China has already provided one. Earlier this year, a firm called DeepSeek claimed it could build ChatGPT-like models at a fraction of the cost of American rivals. Its approach combines more efficient training methods, cheaper hardware and the backing of state and industry.

The implications are stark. If AI becomes cheaper to produce, the premium pricing enjoyed by American tech giants could vanish. Investors are betting on trillion-dollar margins; China is betting on scale and cost-cutting. History suggests the latter often wins.

The pattern is familiar. A decade ago, Chinese firms flooded the world with low-cost solar panels, wiping out many Western competitors and driving global prices to the floor. More recently, they have done the same with electric-vehicle batteries. If AI follows the same script, the profit pool for America’s tech leaders could shrink fast.

For now, DeepSeek is only a warning sign. But it shows that the moat around U.S. AI is shallower than markets assume.

6. How a AI Stock Bubble Could Unravel

Bubbles rarely burst in a single blow. They unravel step by step. Here is one plausible path the AI boom could take if sentiment turns:

- The trigger. A weak earnings report from Nvidia, new U.S. export restrictions, or a sudden jump in interest rates jolts confidence.

- Week one. Funds start selling the Magnificent Seven. Because they dominate ETFs, the selling spills into the broader market.

- Month one. Retail investors panic, redemptions pick up and margin calls force more liquidations. Prices fall faster than fundamentals.

- Months three to twelve. Competitors — from AMD to Chinese challengers — release cheaper chips and models. Oversupply drives down pricing power.

- One to three years. The hype fades. Valuations sink back to earth. A few strong firms survive, but the dream of endless AI-driven profits is gone.

This is not prophecy; it’s pattern. Financial history is littered with booms that followed the same arc: excitement, concentration, over-investment — and then correction. AI may prove no different.

7. Proof Points

A few figures help to show just how unusual this rally has been:

- S&P 500 vs S&P ex-Mag7. Over five years the headline index almost doubled. Excluding those seven firms, returns fall by more than half — back to ordinary levels.

- Concentration. The Mag7 now make up about 33–34% of the index, up from roughly 15% a decade ago.

- Nvidia’s surge. In 2023 alone, Nvidia added more market value than the GDP of many mid-sized countries.

- The median stock. Strip out the top names and most of the S&P looks flat — a reminder that the “American boom” is not as broad as it appears.

According to MacroMicro data, the Magnificent Seven’s share of the S&P 500 has risen steadily to record highs.

8. Conclusion

The past five years of market gains were never as broad as they looked. Strip out the Magnificent Seven and the S&P 500 was plodding along at its usual pace. What investors celebrated as an American boom was really an AI-and-tech boom concentrated in a handful of companies.

This kind of concentration risk is not unique — we’ve seen similar patterns before, as discussed in our article on Indian IT’s trajectory.

That makes the market both dazzling and fragile. Valuations assume flawless growth. Competition is rising, not falling. Regulation and geopolitics hang in the background. And as China’s DeepSeek shows, the moat around U.S. AI dominance may not be nearly as deep as markets hope.

AI is an important long-term technology, but the market’s recent behavior looks a lot like a classic, narrative-driven bubble. If AI growth disappoints, margins get compressed, or regulatory/geopolitical shocks arrive, the unwinding could be rapid. The next several years will reveal whether today’s leaders convert the AI promise into durable profits — or whether the AI stock bubble finally pops.

The last five years were built on AI dreams. The next five will decide whether those dreams become durable value — or the next burst bubble.

Pingback: Understanding Financial Crises: Why They Repeat & How to Spot the Next One - ProsperPocket