Introduction

Africa’s resources have always been part of the global economy, but right now they’re moving from the sidelines to the spotlight. Whether it’s cobalt for electric cars, lithium for batteries, or platinum for green technologies, the world is looking at Africa with new urgency. Big powers are scrambling for a share, while African governments are pushing to capture more value for their own people. This story is about who’s racing ahead, who might fall behind, and why the continent itself holds the keys to the future.

🌍 Did You Know? Africa at a Glance

- 📏 Size: Africa spans 30.3 million sq km — about the same as India, China, the U.S., and much of Europe combined.

- 👶 People: Home to 1.48 billion people (2025 est.), nearly one in five people on Earth. It’s also the youngest continent with a median age of just 19.

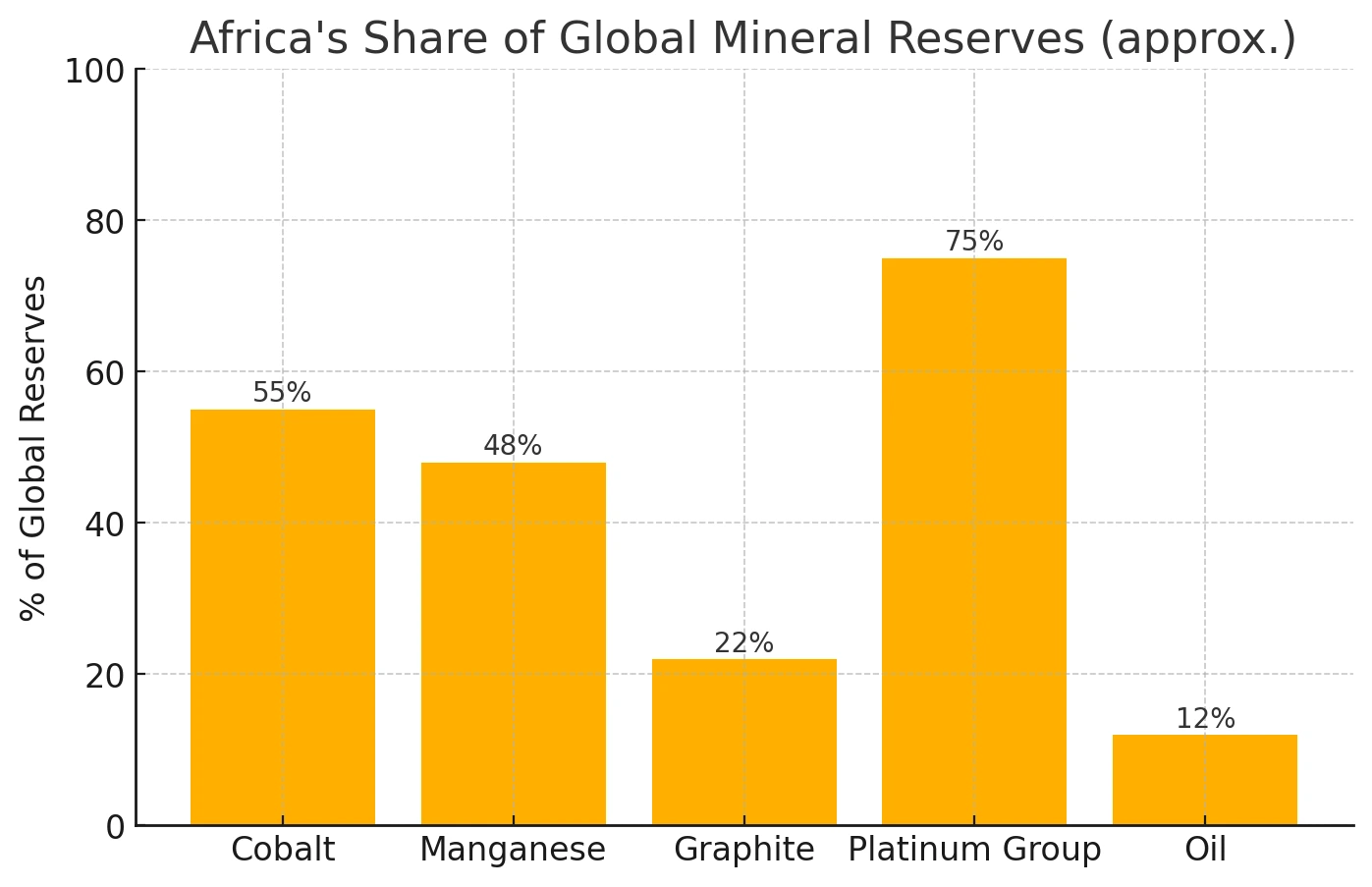

- ⛏️ Mineral Wealth: Holds around 30% of the world’s known reserves, including cobalt, manganese, platinum, oil, and diamonds.

- ⚡ Energy: About 12% of global oil reserves plus massive untapped solar, hydro, and wind potential.

- 💰 Economy: Combined GDP is about US$3.4 trillion in 2025, but per capita income averages just US$2,300 — with sharp contrasts between countries.

- 🌐 Trade: Africa is building the AfCFTA, the largest free trade area in the world by membership, covering 54 countries.

This snapshot shows the paradox: immense resources and a young workforce, but still struggling with inequality and infrastructure gaps. That’s why the resource race matters so much.

Why the race matters

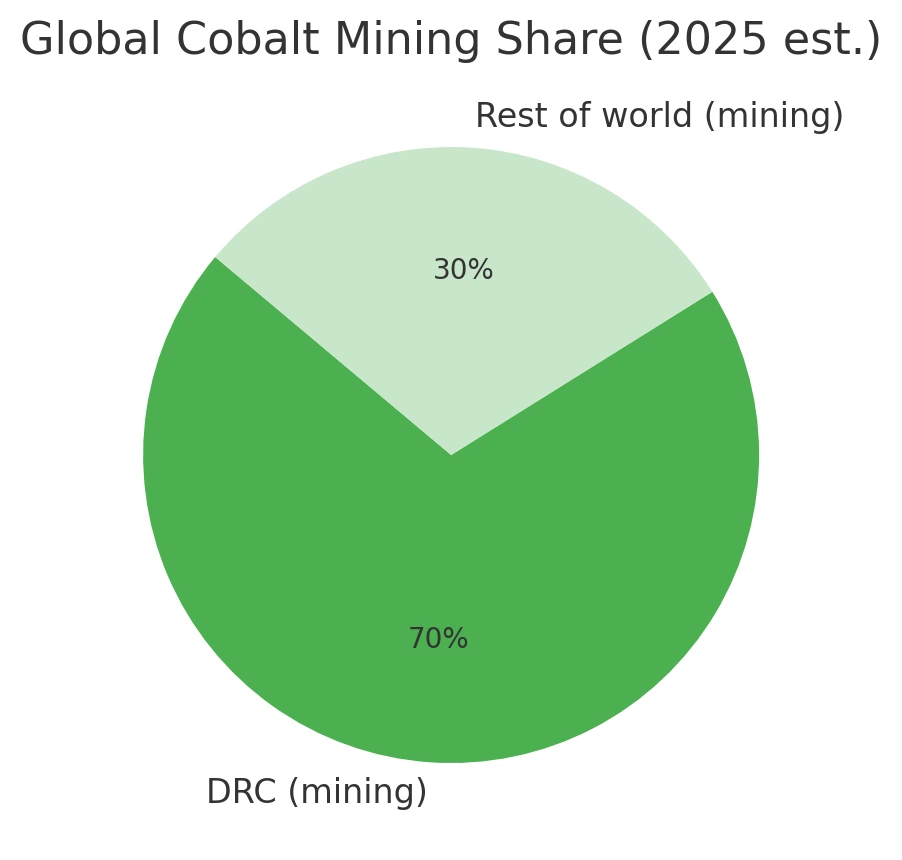

Think of the green transition as a giant shopping list. At the top are cobalt, lithium, rare earths, and other minerals that power everything from smartphones to wind turbines. The catch? A huge share of these resources is locked up in Africa. For example, the Democratic Republic of Congo (DRC) alone supplies about 70% of the world’s cobalt. That makes Africa not just a supplier, but a strategic chokepoint for the 21st-century economy.

Data snapshots – charts

Below are four charts that visualize the core facts we discuss in this article.

Source: USGS Mineral Commodity Summary 2025 (Cobalt), Financial Times — cobalt production in DRC.

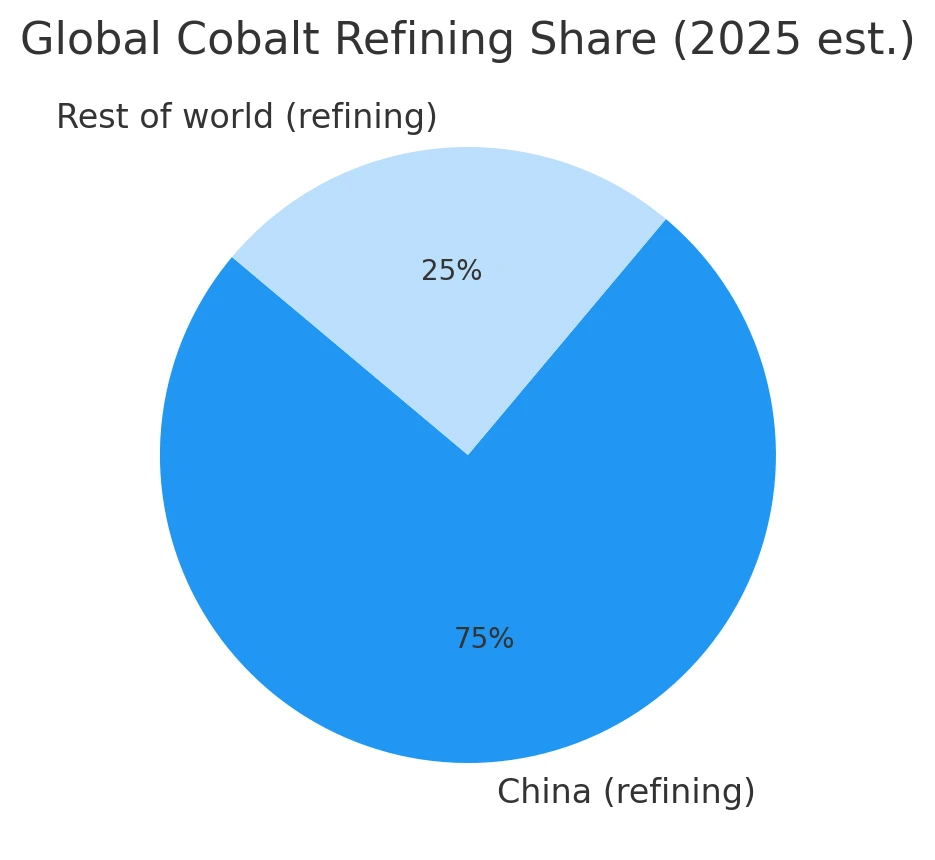

Source: Our World in Data — mining vs refining, IEA — critical minerals report 2024.

Source: UNECA — Africa’s critical mineral resources.

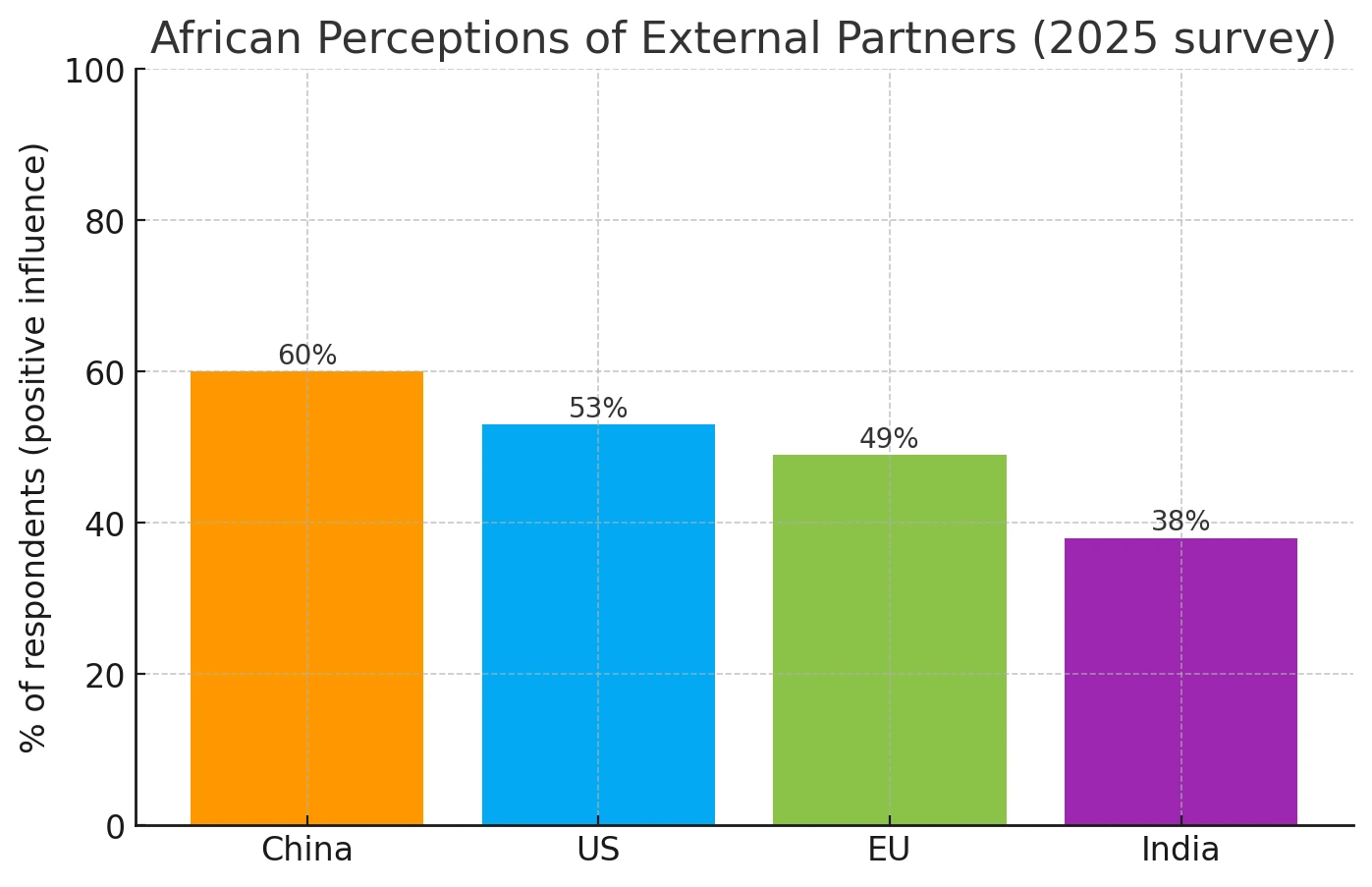

Source: Afrobarometer — Africa Day Survey 2025.

The resources everyone is chasing

Cobalt gets the most attention because it’s essential for batteries, and most of it comes from the DRC. But that’s only part of the story. Zimbabwe and Namibia are betting big on lithium, the “new oil” of the EV age. South Africa and Zimbabwe hold the lion’s share of the world’s platinum and palladium, metals vital for clean energy and industrial use. Meanwhile, countries like Nigeria, Angola, and Algeria still rely heavily on oil and gas exports. And let’s not forget phosphates for fertilizers — without them, the world’s food supply would be in trouble.

Who’s in the game?

So, who’s competing for Africa’s minerals? The cast of characters is as global as it gets.

China has moved the fastest. Its companies own stakes in major mines and, crucially, dominate global refining. Even when Africa does the digging, China often does the processing and captures more value.

The U.S. and Europe are catching up. They’re investing in “clean” supply chains, pushing ESG (environmental and social governance) standards, and offering financing to reduce reliance on China. But their projects often move slower.

India is stepping up, especially in Zambia, South Africa, and Zimbabwe. Beyond mining rights, Indian firms are also investing in infrastructure and power projects, aiming to build long-term trust.

Russia plays a different game, often bundling mining deals with military or security cooperation. It’s less about scale, more about influence in specific countries.

And then there’s Africa itself. Countries are no longer just handing over raw materials. From Zimbabwe’s lithium export bans to the DRC’s push for local processing, governments are rewriting the rules. The African Union is also pushing for regional cooperation under AfCFTA to boost local industries.

How the race is being played

The strategies vary, but some patterns stand out. Foreign players often promise big infrastructure projects — roads, ports, power plants — in exchange for mining rights. Others sign long-term supply deals that lock in resources for decades. African governments, in turn, are demanding beneficiation: processing and refining on the continent, not just raw exports. Security and military support also come into play, especially in unstable regions where resource wealth can fuel conflict.

Who’s ahead?

If we had to call it today, China still leads by a wide margin. Its combination of financing, technical know-how, and refining dominance gives it an edge. But the gap is narrowing. Western governments are speeding up, India is making meaningful inroads, and African states themselves are playing harder ball with investors. The outcome will depend on how much leverage African leaders can hold — and whether they can resist the old “resource curse” of corruption and conflict.

The risks if things go wrong

History offers plenty of warnings. Resource wealth can fuel inequality and corruption if revenues don’t reach ordinary people. Mining, if poorly regulated, can damage land, water, and communities. And when great powers compete, there’s always the risk that Africa becomes a pawn in bigger geopolitical struggles rather than the master of its own future.

What Africa can do differently this time

There are clear ways forward. Countries can insist on local processing so more jobs and profits stay in-country. Stronger governance — transparent contracts, competitive bids, public audits — can keep deals fair. Diversifying partners reduces dependency and increases bargaining power. And perhaps most importantly, channeling resource revenues into education, infrastructure, and industry can turn one-time booms into lasting prosperity. On a continental level, AfCFTA gives Africa the chance to build regional value chains instead of competing individually.

Looking ahead

The next few years will be telling. Watch how DRC handles its cobalt, how Zimbabwe enforces its lithium rules, and how the African Union pushes for fairer governance. The resource race isn’t just about who gets Africa’s minerals — it’s about whether Africa itself can finally turn its natural wealth into sustainable development.

Author note: This piece is written for general readers interested in how geopolitics and economics intersect over Africa’s resources. Data visualisations are approximate and illustrative.

Pingback: From OPEC to OMEC: Investing in the Critical Minerals Supercycle - ProsperPocket