The revolution at the dinner table

Picture this: it’s a Sunday evening in Indore. A young couple scrolls through their brand-new smartphones. They order groceries on an app, pay with UPI, and dream about their first SUV. Their parents grew up in a world of ration cards and long queues; they are living in a world of instant deliveries and EMI offers. Multiply this story by millions, and you understand what’s happening in India.

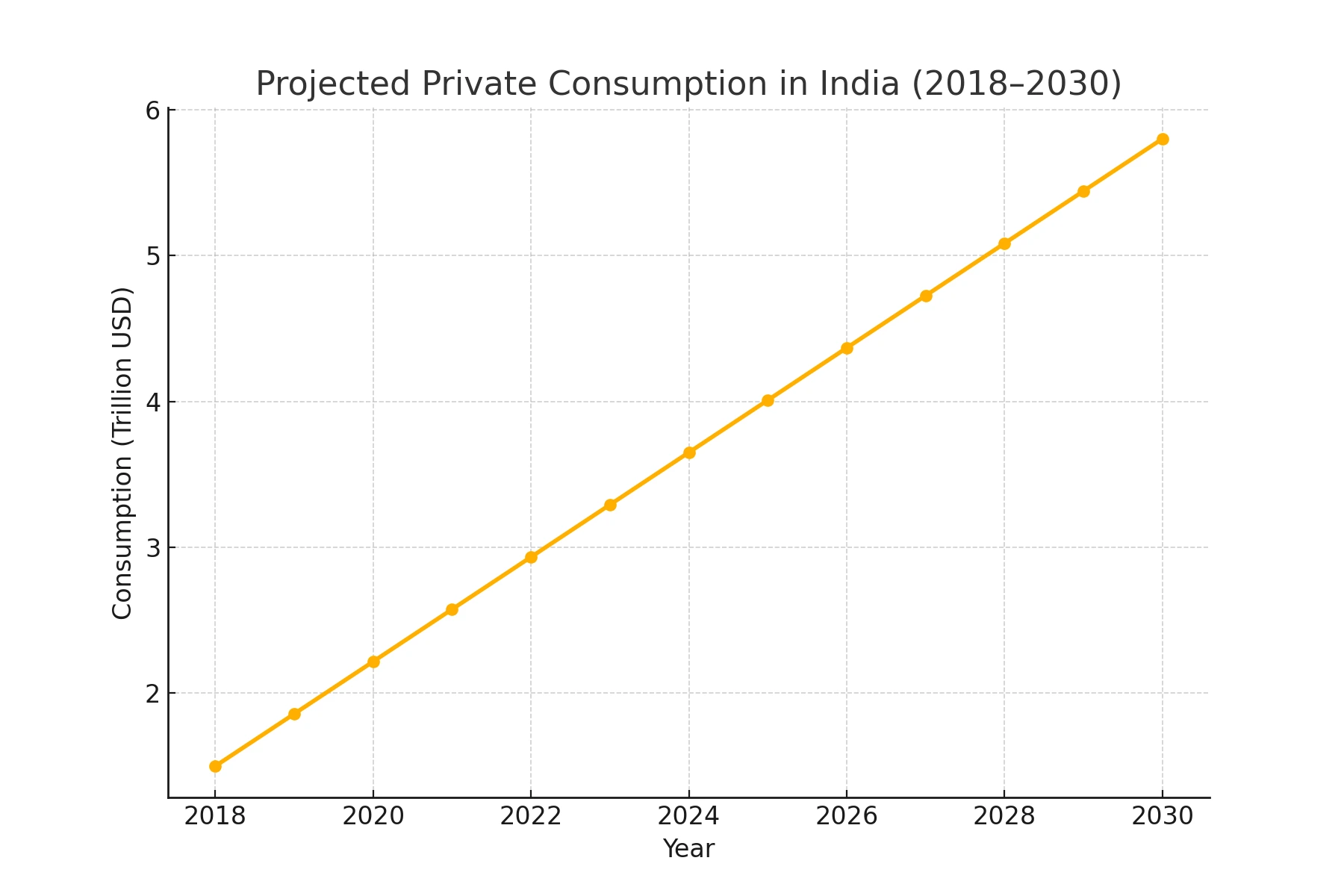

For years, the world looked at India as the back office — coders in Bengaluru, call centers in Gurugram, factories in Gujarat. That’s still true, but the bigger story of the 2020s is demand, not supply. India’s middle class is swelling, and with it comes trillions of dollars in new consumption. Analysts project India’s consumer spending could hit $6 trillion by 2030 — the equivalent of adding an entire Japan inside India in just one decade. Bain & Company

Who counts as “middle class” — and why it matters

Defining “middle class” is slippery. Economists use income bands like $10–50 per person per day (PPP). Sociologists look at lifestyle markers — two-wheeler ownership, air-conditioners, the ability to eat out once a week. However you slice it, the trend line is clear: hundreds of millions of Indians are moving up. Brookings

Estimates vary, but today India likely has 350–400 million middle-class consumers. By 2030, that number could climb to 600–700 million. That means nearly one in four new middle-class consumers worldwide this decade will be Indian. For companies chasing growth, that is not a footnote — it’s the headline.

The scale in numbers — and in real life

- Private consumption: projected at $5.7–6 trillion by 2030. That’s larger than the current consumer markets of Germany and the UK combined. Bain, WEF

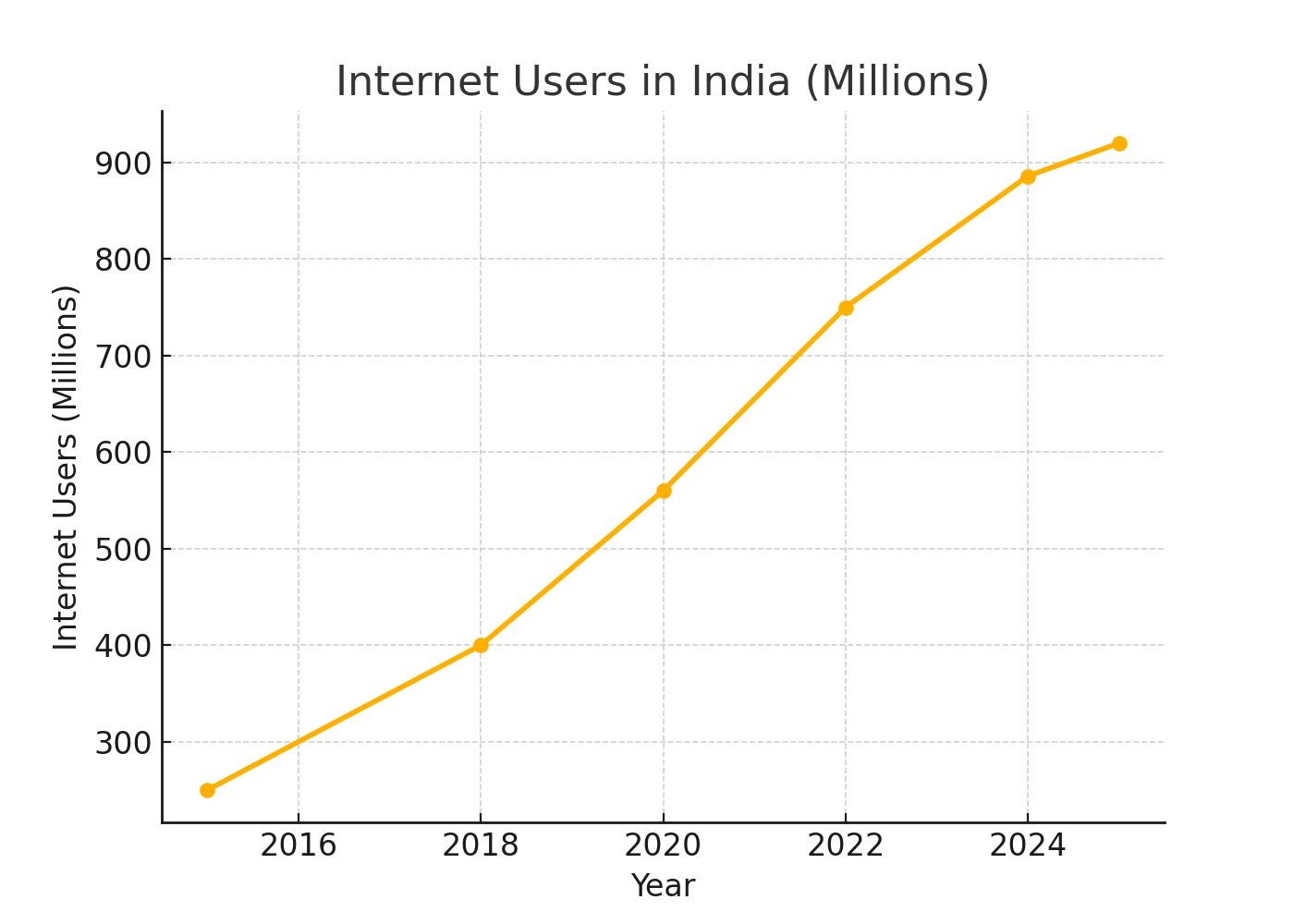

- Internet users: nearly 900 million by 2025. That’s three times the population of the United States. IBEF

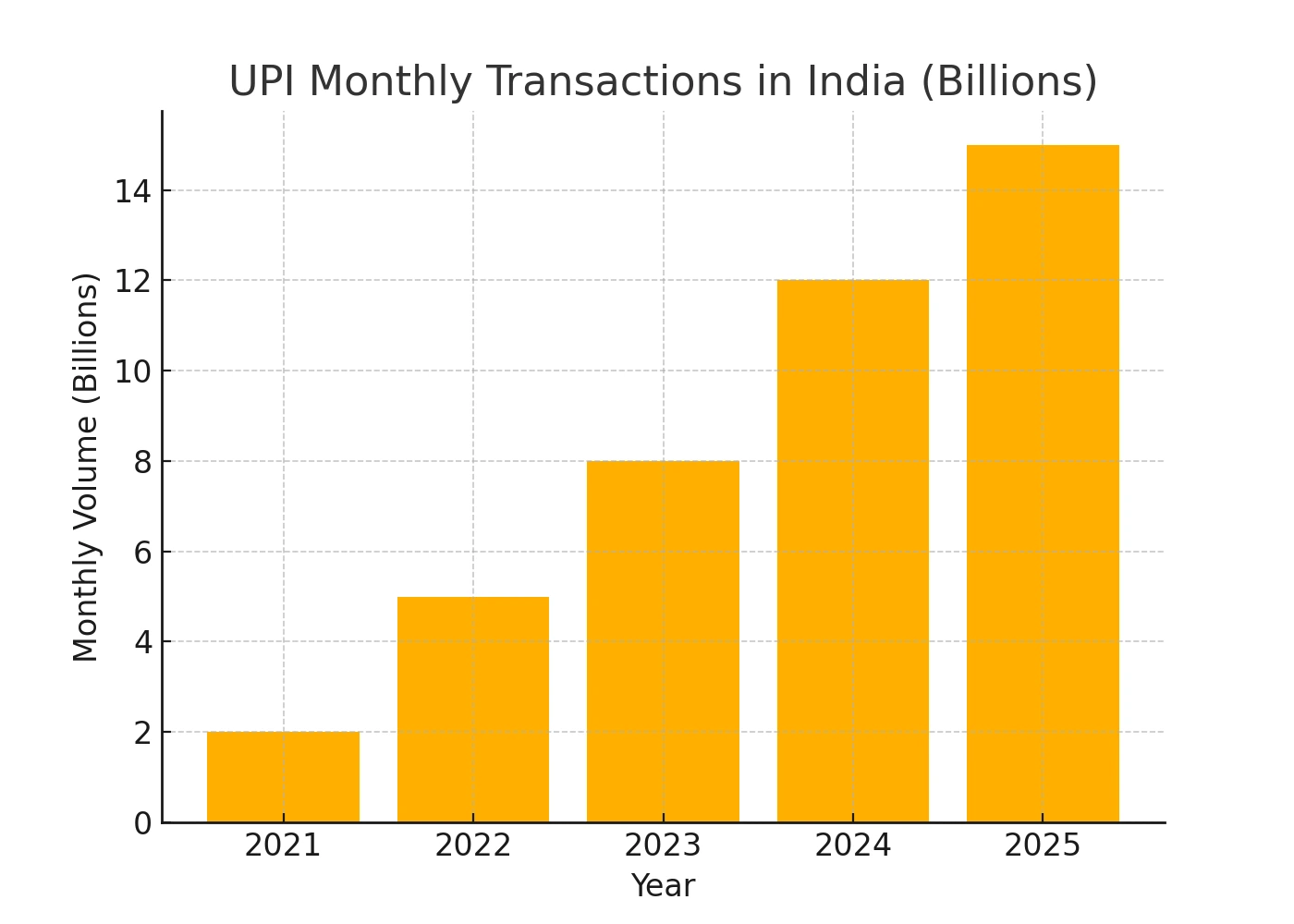

- UPI payments: hundreds of millions of transactions every day. India now runs the largest real-time payments system on earth. NPCI

- Per-capita GDP: crossed $2,600 in 2024. That’s still modest, but enough to push millions into aspirational spending. World Bank

But numbers don’t tell the whole story. Walk through a Diwali market in Kanpur. Families are not just buying sweets and diyas — they’re upgrading to 55-inch TVs, booking Bali vacations, and signing their first EMI plans. That’s the middle class in action.

Also Read

Five sectors where the middle class is rewriting the script

The rise of India’s middle class isn’t just an abstract number. You can see it play out in shopfronts, payment apps, vehicle showrooms, and holiday bookings. Everyday choices are quietly reshaping entire industries.

Digital & Mobile

In the mid-2000s, a mobile phone was a prized possession. Today, a smartphone is basic infrastructure. With cheap data and regional-language apps, India’s internet boom has spilled far beyond metros. By 2025, close to 900 million Indians will be online — more than the entire population of Europe. That’s not just connectivity; it’s a ready-made marketplace for shopping, streaming, and skilling.

Payments & Fintech

Walk up to a chai stall and you’ll likely find a UPI QR code taped to the kettle. What was once a cash-only economy is now running on billions of digital transactions each month. For fintechs, this creates an entry point into micro-credit, savings, and insurance for first-time users who have never walked into a bank branch.

Automobiles & EVs

For years, the symbol of arrival was a scooter parked outside the house. Today it’s a compact SUV; tomorrow it may be an electric car. Rising incomes are turning car ownership from a dream into an expectation. Whether India jumps straight to EVs or follows the petrol-first path, the middle class will decide the direction of global auto markets.

FMCG & Retail

In the 1990s, single-use shampoo sachets made FMCG giants rich. Now, those same households are trading up — to branded snacks, premium cosmetics, even luxury chocolates. The kirana store remains important, but malls and e-commerce carts are filling fast. Premiumisation is visible when a family that once bought loose tea now orders a café latte.

Leisure & Experiences

The middle class doesn’t only spend on goods; it spends on moments. Dining out, multiplex weekends, fitness clubs, and foreign holidays are no longer reserved for the elite. Airlines are reporting record bookings from tier-2 cities. This shift marks a cultural turn: from saving only for security to spending also for memories.

Taken together, these changes explain why the middle class is more than an income bracket. It’s a force reshaping industries, setting new aspirations, and creating the contours of the next big global consumer story.

India vs China — the long runway

China was the middle-class miracle of the 2000s. It powered luxury sales, global car markets, and commodity cycles. But China is aging; its growth is slowing. India, meanwhile, has a median age of just 29. That gives it decades of consumer runway. Put simply: where China’s demand story peaked, India’s is just beginning. UN Population Data

The paradoxes we can’t ignore

Every growth story has shadows. India’s middle class is rising, but so is inequality. The top 10% hold most of the wealth. Youth unemployment is high. And inflation — whether it’s onions or petrol — can squeeze household budgets overnight. Walk into a village haat and you’ll still see cash notes, not QR codes. That’s the paradox: dazzling digital adoption coexists with old-world frugality.

Three charts that show the scale

What businesses need to do now

The opportunity is massive, but capturing it requires strategy tuned to India’s realities. Here’s what businesses and investors should keep front of mind:

1. Think beyond metros

The top 10 cities are already saturated with global brands. The real battleground is tier-2 and tier-3 cities. Towns like Surat, Jaipur, and Patna are home to aspirational families with rising incomes and digital access. Businesses must invest in distribution and local engagement there, not just in Delhi or Mumbai.

2. Get the price right

Indian consumers are famously price-sensitive, but they’re also brand-conscious. A ₹99 subscription can attract millions more users than a ₹199 one. Profitability here comes not from fat margins but from volume at scale. Companies must experiment with micro-pricing, sachets, and “lite” versions.

3. Design for India, not the West

A Western app may fail in India if it assumes high bandwidth or English-only content. Success requires regional languages, voice-based interfaces, and EMI-friendly pricing. Even luxury buyers often pay in installments — that’s cultural reality, not weakness.

4. Partner local

Distribution and trust in India run through local networks: kirana stores, community groups, and regional influencers. Multinationals that enter solo often stumble. Partnerships with local companies or startups can accelerate adoption and cut costs.

Conclusion — looking ahead to 2030

Fast-forward a few years. Imagine 700 million Indians shopping online, paying seamlessly via UPI, and driving EVs down city highways. Picture families in Lucknow or Coimbatore booking summer trips to Singapore, or proudly walking into malls where Indian brands sit next to Gucci and Apple. That’s not a distant dream — it’s the logical outcome of the middle-class boom already underway.

But remember the paradoxes. Jobs, inequality, and infrastructure will decide whether this is a broad-based revolution or a patchy one. The stakes are high, but so is the prize.

For the global economy, the message is blunt: just as China’s consumers reshaped demand in the 2000s, India’s middle class will redraw the map in the 2020s. For businesses, policymakers, and investors, the next billion consumers are not just numbers on a chart — they are real people, with aspirations that will shape the future, one purchase at a time.