But relying on that same playbook for the next ten years isn’t just lazy; it’s financially dangerous. The center of economic gravity is shifting, and it’s moving away from the Atlantic. While the West grapples with aging populations, mounting sovereign debt, and political gridlock, the “Global South” is entering a period of structural acceleration.

The math is becoming undeniable. If your capital stays exclusively in Developed Markets (DM), it is effectively fighting gravity. To capture real growth in 2026 and beyond, investors need to look at the map differently.

The Widening Gap: A Tale of Two Growth Rates

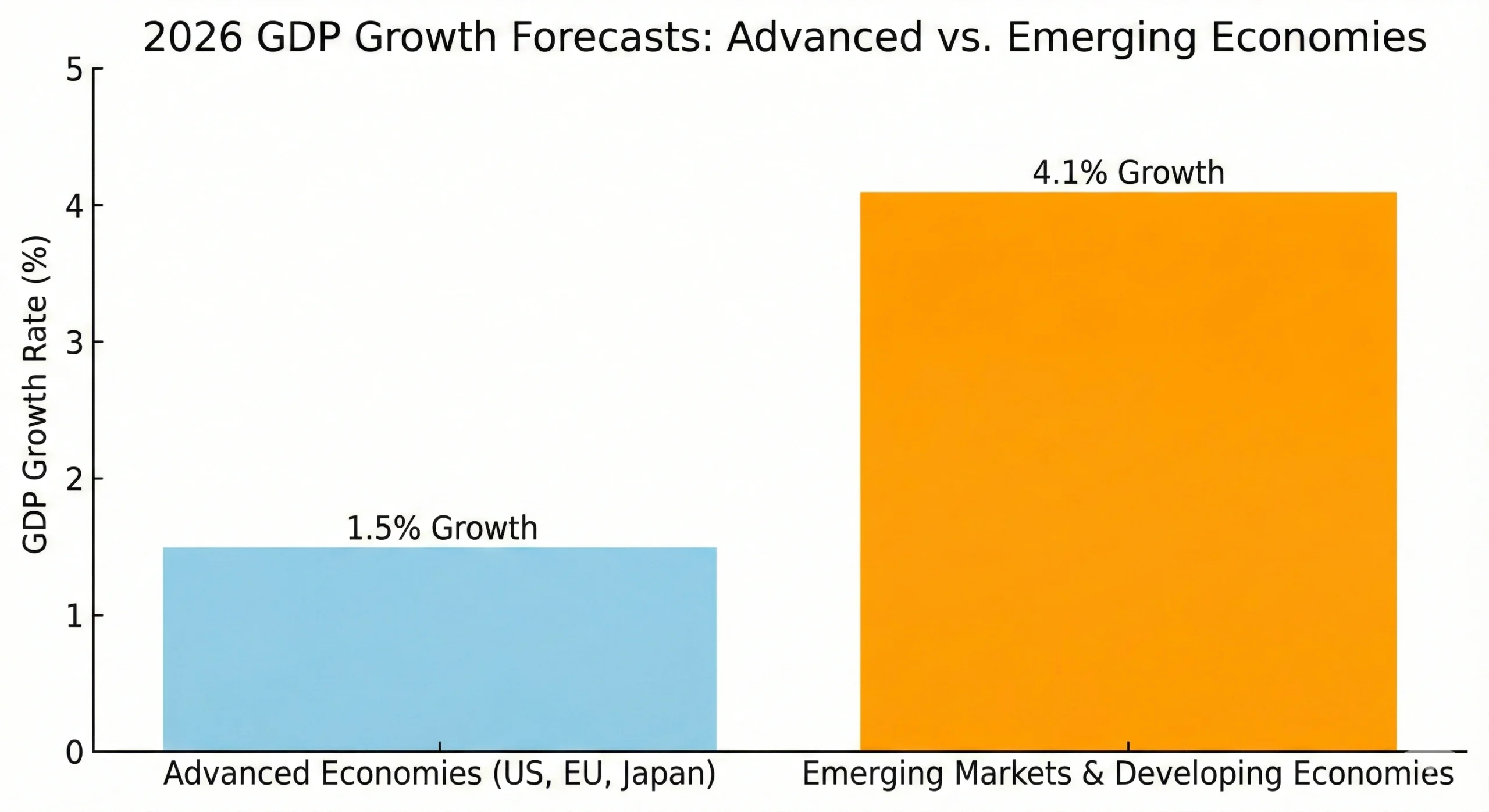

Let’s look past the headlines and stare directly at the engine room of the global economy. We are witnessing a divergence in growth rates that we haven’t seen since the early 2000s, and it fundamentally changes the risk-reward calculus for asset allocation.

Advanced economies—the US, Western Europe, Japan—are entering a phase of what economists call “secular stagnation.” Growth forecasts for late 2026 are hovering around 1.5% to 1.6%. That is barely enough to keep the lights on and service the debt. It describes a low-growth, high-cost environment where gains are hard-won.

Meanwhile, Emerging Markets (EM) and Developing Economies are projected to sprint ahead at 4.1%.

This isn’t a rounding error; it’s a structural gap. When you compound that 2.5% difference over a decade, the wealth effect is massive. The West is trying to “manage decline” and pivot to green energy without breaking the bank. The Emerging World is simply trying to get rich. That hunger drives returns.

“The West is growing at 1.5%. The Global South is sprinting at 4%. If your portfolio is 100% developed markets, you’re betting on the wrong horse.

The Demographic Cliff vs. The Dividend

You cannot fake demographics. A country either has workers, or it doesn’t. And right now, the Developed World is running out of them.

Europe and Japan are effectively turning into nursing homes with flags. The median age in Germany is pushing 45. In Japan, it’s nearly 50. Even the United States, which has historically been bailed out by robust immigration, is seeing its workforce participation flatten. An older population is deflationary for growth but inflationary for social costs. They save more, spend less, and require massive healthcare expenditures.

Now, look at the other side of the ledger. The “Global South” is experiencing a youth bulge that acts as rocket fuel for consumption.

- India: Median age of 28.

- Nigeria: Median age of 18.

- The Philippines: Median age of 25.

Also read: The economic cost of emptiness: What population collapse means for market.

These aren’t just statistics; they are the next wave of global consumption. A 28-year-old in Mumbai isn’t worried about bond yields or retirement homes; they are entering their prime spending years. They are buying their first car, taking out a mortgage, and upgrading their smartphone.

This is the “Demographic Dividend.” It creates a natural floor for economic growth that aging Western nations simply cannot replicate. When you invest in these markets, you aren’t betting on a government; you are betting on the inevitable rise of a young, hungry middle class.

The BRICS+ Factor and New Financial Plumbing

For decades, investing in Emerging Markets felt like a side bet. You bought a volatile ETF, hoped for the best, and accepted that everything was priced in US Dollars.

That dynamic has changed with the expansion of BRICS+. The inclusion of heavyweights like the UAE, Saudi Arabia, Egypt, and strategic partners like Indonesia has given the bloc serious financial teeth. We are no longer just talking about cheap manufacturing; we are talking about nations that control the energy markets, the shipping lanes, and the capital flows.

They are building their own rails. We are seeing a massive surge in “South-South” trade. Brazil selling soy to China, India buying oil from the UAE—increasingly, these transactions are bypassing the US Dollar and Western banking systems (SWIFT).

This “de-dollarization” isn’t happening overnight, and the Dollar isn’t going to zero. But the monopoly of the Dollar is ending. A portfolio that ignores this parallel system is blind to half the world’s economic activity.

Country Spotlights: Where to Look?

“Emerging Markets” is a lazy term. It lumps together dynamic tech hubs with failing states. To succeed in 2026, you need to be surgical. Here are three specific markets that define the opportunity.

1. The India Story: Digital Public Infrastructure

India is doing what China did 20 years ago, but with a digital twist. The government’s massive push for infrastructure—both physical (roads, airports) and digital (the “India Stack”)—has transformed the economy.

The Unified Payments Interface (UPI) has allowed hundreds of millions of people to move from cash to instant digital payments in less than five years. This has drastically reduced the cost of customer acquisition for banks and fintechs. When you invest in Indian financials, you are investing in the formalization of a massive informal economy.

2. Saudi Arabia: The Great Pivot

Saudi Arabia is arguably the most misunderstood investment story right now. Under Vision 2030, they are aggressively diversifying away from oil. The Sovereign Wealth Fund (PIF) is pouring billions into creating entirely new industries from scratch—Gaming, Tourism, and Green Hydrogen.

This isn’t a free market in the Western sense, but the capital flows are undeniable. The region is becoming a magnet for talent and investment, acting as a bridge between Europe, Asia, and Africa.

3. Vietnam & Mexico: The “China Plus One” Winners

As geopolitical tensions rise between the US and China, corporations are frantically “de-risking” their supply chains. They aren’t leaving China entirely, but they are moving new capacity elsewhere.

Vietnam and Mexico are the biggest beneficiaries. Vietnam has become the electronics hub of Southeast Asia, while Mexico is capitalizing on “near-shoring” to the US market. Industrial real estate and logistics companies in these regions are effectively charging rent on the reorganization of global trade.

Sector Spotlight: It’s Not Just Commodities Anymore

A common mistake investors make is thinking EM investing is just about buying oil companies or miners. That was true in 2005. In 2025, the picture is different. The real alpha is in sectors that are leapfrogging Western development models.

1. Fintech and Digital Rails

Emerging markets often skip steps. They didn’t build landlines; they went straight to mobile. They aren’t building bank branches; they are banking on apps. Look for “Super-Apps” in Southeast Asia or fintech giants in Latin America. These companies are effectively utilities for the modern age, creating moats that Western tech giants struggle to cross because they don’t understand the local hyper-complexities.

2. Healthcare and Insurance

This is the boring, unsexy, million-dollar trade. When a family in Indonesia moves from “poor” to “middle class,” the first thing they buy isn’t a Gucci bag; it’s better healthcare and life insurance. The penetration rate of insurance in India or Brazil is still in the low single digits. The runway for growth is miles long.

3. The Green Grid

The Global South is the sunniest place on Earth. While the West fights over retrofitting old grids and NIMBY (Not In My Backyard) protests, places like Chile, Morocco, and North-West India are building massive solar and wind projects from scratch. They have the land and the sun; they just need the capital.

The Risks: No Free Lunch

We need to be honest. Investing in emerging markets is not a smooth ride. If the S&P 500 is a Volvo, Emerging Markets are a Ducati. Fast, exciting, but dangerous if you don’t know what you are doing.

Currency Risk is the silent killer. You can pick a stock in Brazil that goes up 10%, but if the Brazilian Real drops 15% against the Dollar, you have lost money. Hedging strategies or focusing on exporters who earn in Dollars can mitigate this.

Governance remains a hurdle. Policies can change overnight. However, the risk premium is often priced in. The key is diversification. Never bet the house on one country. A “basket” approach protects you if one nation goes through a political crisis.

The Bottom Line: The Cost of Comfort

Investing in the US and Europe feels comfortable. You know the brands. You speak the language. You understand the laws. Investing in the Global South feels uncomfortable. The names are unfamiliar. The politics are messy.

But in financial markets, comfort is expensive. You pay a premium for safety, which suppresses your potential yields. The “uncomfortable” assets are where the growth is priced cheaply.

As we head toward 2030, the investors who are willing to embrace the messiness, the youth, and the energy of the Global South are the ones who will likely outperform. The map has changed. Don’t get lost using the old one.

Want to play on a phone? Check S666 Appbiz! Great experience and awesome platform. Do it now! S666appbizs666appbiz