Financial crises may look shocking when they arrive, but history shows that they are nothing new. From Tulip Mania in 1637 to the 2020 COVID Crash, economies have gone through repeated cycles of boom and bust. Money, after all, is just an agreement — “pieces of paper with pictures on it so we don’t have to kill each other for food,” as famously said in the movie Margin Call.

A Brief History of Financial Crises

A History of Market Panic: The Major Crashes

To understand where we might be heading, we have to look at where we’ve been. Here are the watershed moments that taught us hard lessons about risk, greed, and fear:

- 1637 – Tulip Mania (The Original Bubble): Before Bitcoin or tech stocks, there were flowers. In the Netherlands, speculation hit such a fever pitch that a single tulip bulb sold for the price of a mansion. When the “greater fool” theory finally failed, prices collapsed overnight, leaving people holding worthless roots instead of riches.

- 1720 – The South Sea Bubble (UK): A frenzy of speculation surrounding a British shipping company that promised endless riches from trade with the Americas. It lured in everyone from peasants to Sir Isaac Newton. When the hype died down, it wiped out fortunes and redefined how the public viewed the stock market.

- 1929 – The Great Depression: The Roaring Twenties hit a brick wall. What started as a stock market crash in New York spiraled into a decade-long global economic nightmare, marked by massive unemployment, soup lines, and a complete loss of faith in the financial system.

- 1973–74 – The Oil Crisis: This wasn’t just about charts; it was geopolitical. An oil embargo caused prices to quadruple, leading to “stagflation”—a painful mix of stagnant economic growth and skyrocketing inflation—that puzzled economists and squeezed consumers at the pump.

- 1987 – Black Monday: On October 19th, markets didn’t just slide; they fell off a cliff. The Dow dropped over 22% in a single day. It was the first crash accelerated by “program trading,” giving the world a scary preview of how algorithms could worsen a panic.

- 1997 – Asian Financial Crisis: Known as the “Asian Contagion,” this started when Thailand unpegged its currency from the US dollar. The shockwave toppled currencies and stock markets across South Korea, Indonesia, and beyond, proving just how interconnected the modern global economy had become.

- 2000 – The Dot-com Bubble: If a company had “.com” in its name, investors threw money at it. Valuations were completely detached from reality (and profits). When the euphoria faded, trillions of dollars in paper wealth evaporated, destroying countless tech startups along the way.

- 2008 – The Global Financial Crisis: The housing market, usually a safe bet, turned into a house of cards built on subprime mortgages. When the bubble burst, major banks like Lehman Brothers collapsed, credit markets froze, and the world entered the “Great Recession.”

- 2020 – The Covid-19 Crash: A crash with no financial culprit. As the pandemic forced a global shutdown, uncertainty triggered one of the fastest market drops in history. However, massive government stimulus also fueled one of the fastest recoveries we’ve ever seen.

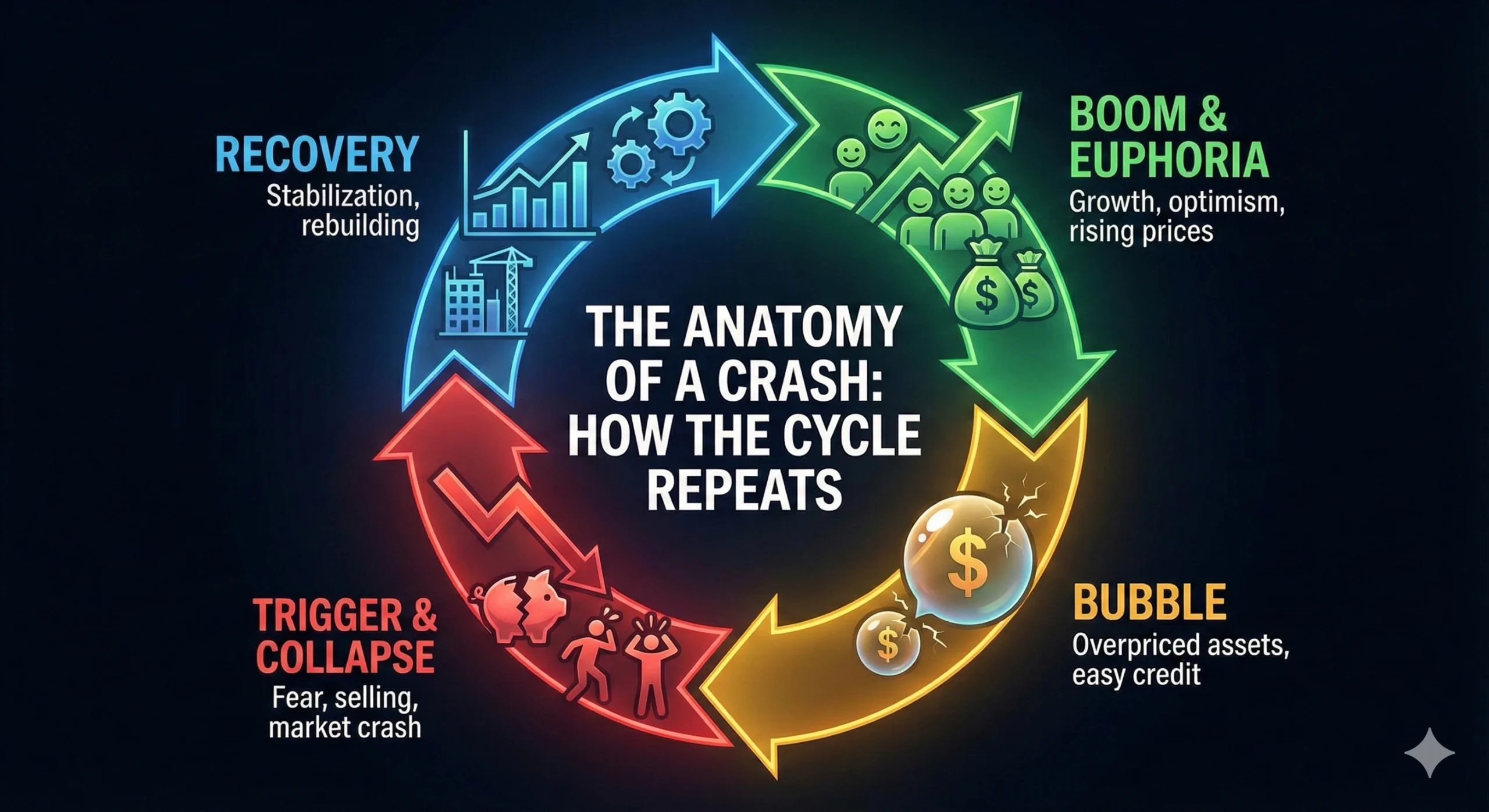

The Anatomy of a Crash: How the Cycle Repeats

While the specific catalysts change—sometimes it’s tulips, other times it’s tech stocks or housing—the human behavior driving the cycle remains shockingly consistent. Economists often break this emotional rollercoaster into six distinct phases:

- 1. The Boom (The “Smart” Phase): This is the healthy start. The economy is growing, employment is up, and investing makes sense. There is genuine innovation or prosperity driving the numbers. It feels safe, sustainable, and logical.

- 2. Euphoria (The “FOMO” Phase): Logic exits the building. Prices start rising faster than they should, and the “Fear Of Missing Out” kicks in. You start hearing ordinary people giving stock tips at dinner parties. The dangerous phrase “This time is different” becomes the collective mantra.

- 3. The Bubble (Peak Insanity): Asset prices completely detach from reality. Investors are no longer buying because of value; they are buying because they think they can sell to someone else for more tomorrow. This is often fueled by cheap debt and reckless leverage.

- 4. The Trigger (The Pin Prick): The party stops, often suddenly. It doesn’t always take a war or a massive bankruptcy; sometimes it’s just a subtle rise in interest rates or a disappointing earnings report. It’s the moment investors collectively wake up and realize the emperor has no clothes.

- 5. Panic & Collapse (The Rush for the Exits): Greed instantly flips to fear. Everyone tries to sell at the same time, but there are no buyers. Asset values freefall, margin calls are triggered, and paper fortunes evaporate. This is the moment of maximum financial danger.

- 6. Recovery (The Reset): Eventually, the dust settles. Prices hit rock bottom, making them attractive to smart, long-term investors again. Central banks usually step in with support, confidence slowly returns, and the seeds for the next boom are quietly planted.

Warning Signs: How to Spot the Smoke Before the Fire

If there is one rule in finance, it’s that no one has a crystal ball. You cannot predict the exact Tuesday a crisis will start. However, history leaves clues. Think of these as the dashboard warning lights of the global economy—when they start blinking in unison, it’s time to pay attention.

- 1. Asset Bubbles (Valuations That Defy Gravity): Whether it’s stocks, real estate, or the latest crypto-coin, be wary when prices detach from reality. A classic “canary in the coal mine” is when your taxi driver or dentist starts giving you “can’t-miss” investment tips. When everyone is convinced an asset can only go up, it usually has nowhere left to go but down.

- 2. The Debt Trap (Excessive Leverage): Economies run on credit, but there is a limit. When corporations and governments are drowning in debt, they become incredibly fragile. It’s like a household living entirely on credit cards—one unexpected expense (or a drop in income) can cause the whole structure to collapse.

- 3. The Central Bank Pivot (Rapid Rate Hikes): Central banks like the US Fed or the RBI control the flow of money. When they hike interest rates quickly to fight inflation, they are essentially taking the punch bowl away from the party. Money becomes expensive, borrowing slows down, and businesses that relied on cheap cash often break.

- 4. Cracks in the Banking System: Banks are the plumbing of the economy. When you start seeing headlines about liquidity shortages, surprise defaults, or bank runs, the plumbing is leaking. Financial stress tends to be contagious; one bank’s failure often reveals weaknesses in others.

- 5. The Inverted Yield Curve (The Bond Market’s Prophecy): This is the technical indicator with the spookiest track record. In a healthy economy, long-term bonds pay more than short-term ones. [attachment_0](attachment) When that flips (and short-term rates get higher), it means investors are terrified of the near future. It has successfully predicted almost every recession in the last 50 years.

- 6. The Geopolitical Wildcard: Sometimes the trigger isn’t financial at all. Wars, trade embargos, or energy supply shocks can blindside markets. These “Black Swan” events are impossible to model on a spreadsheet, but they cause immediate panic by disrupting the supply chains we take for granted.

Where We Stand: The Economic Landscape of 2025

As we look at the snapshot of the global economy in August 2025, the picture is one of precarious balance. We aren’t necessarily in a crisis, but the warning lights we talked about earlier are flickering. Here is the pressure cooking under the surface:

- The Global Debt Hangover: After years of borrowing, the bill is coming due. Governments, corporations, and regular households are sitting on a mountain of debt. In a high-interest world, servicing this debt is becoming a massive burden, leaving less money for growth or spending.

- The End of “Cheap Money”: Central banks, including the RBI and the Federal Reserve, have kept interest rates high to suffocate inflation. While this was necessary medicine, the side effects are painful. Borrowing for a home, a car, or a business expansion is significantly more expensive than it was just a few years ago.

- Real Estate Tremors: The property market is showing cracks in the foundation. Commercial real estate is struggling with the shift to remote work (leaving office towers empty), while high mortgage rates are putting a freeze on the residential housing market. It’s a standoff between buyers who can’t afford to buy and sellers who refuse to lower prices.

- The AI Gold Rush (Or Bubble?): Artificial Intelligence has sparked a massive boom in tech stocks, reminiscent of the late 90s. While the technology is revolutionary, valuations are stretching into the stratosphere. Investors are asking the uncomfortable question: Are we paying for future growth, or just buying into the hype?

- A Fractured World: Geopolitics is no longer a sidebar; it’s the main story. Ongoing conflicts and trade disputes are rewriting the rules of globalization. Supply chains are being redrawn, adding cost and uncertainty to everything from microchips to crude oil.

Also read: AI stock bubble 2025

Fortifying Your Finances: How to Weather the Storm

We cannot stop the rain from falling, but we can certainly fix the roof before the storm hits. You don’t need to be a Wall Street tycoon to protect yourself; you just need to follow a few timeless principles of financial survival:

- 1. The Art of Not Going “All In” (Diversification): It’s the oldest rule in the book for a reason. [attachment_1](attachment) If all your money is in tech stocks and the tech bubble bursts, you are wiped out. But if you have a mix—some stocks, some gold, some bonds, maybe some real estate—when one goes down, the others often stay steady to cushion the blow.

- 2. Build a “Sleep Well” Fund: Cash is king during a crisis. Aim to keep at least 6 months of living expenses in a liquid, easily accessible account. This isn’t an investment to get rich on; it’s an insurance policy. It ensures that if you lose your job or face a medical emergency, you aren’t forced to sell your long-term investments at rock-bottom prices just to pay the bills.

- 3. Travel Light (Minimize High-Interest Debt): In a booming economy, leverage (borrowing) can feel like a superpower. In a crash, it’s an anchor. High-interest debt, like credit card balances, becomes suffocating when the economy slows down. Aggressively paying this down now is the best “guaranteed return” you can get.

- 4. Watch the Watchmen (Follow the Central Banks): You don’t need a PhD in economics, but you should keep an eye on what the “big guys” are doing. If the RBI or the Fed is raising rates, money is getting tighter. This is usually a signal to be more conservative with your spending and investing decisions.

- 5. Filter the Signal from the Noise: In the age of 24-hour news cycles, panic sells. Staying informed is crucial, but obsessing over every sensational headline will lead to bad emotional decisions. Focus on long-term trends rather than daily fluctuations.

The Bottom Line

Here is the truth about financial crises: they aren’t accidents. They aren’t glitches. They are just part of the deal.

Markets are driven by people, and people are driven by fear and greed. That cycle hasn’t changed in 400 years, and it isn’t going to change by 2025. But knowing that gives you an edge.

Most people panic when the headlines turn red. They sell at the bottom because they’re scared. But if you understand the history, you don’t have to play that game. You can look at a crash and see it for what it really is: a temporary sale on the world’s best assets.

The storm will come eventually. It always does. The only question is, will you be the person panicked about the rain, or the one who already fixed the roof?

Related Reading: